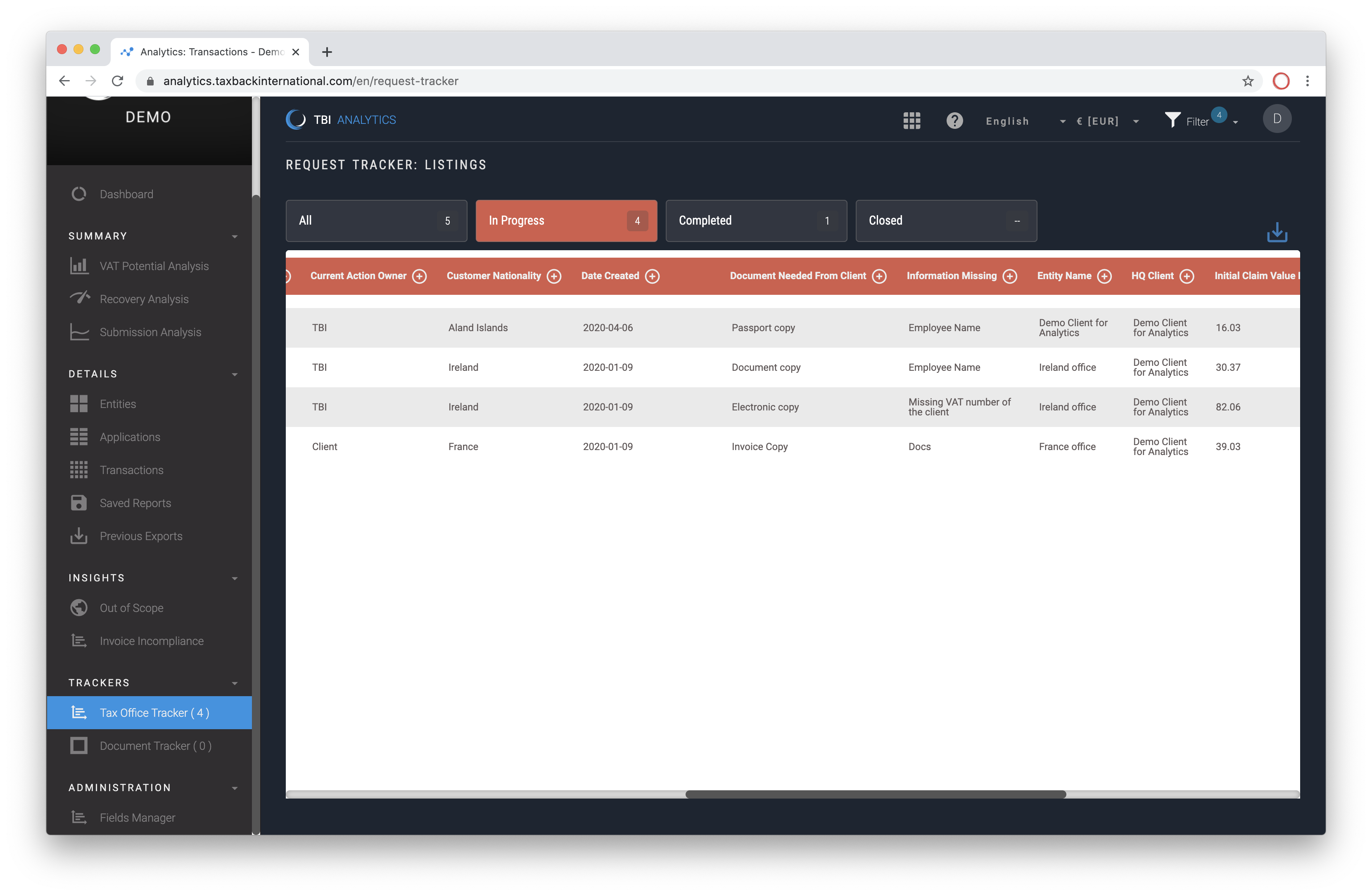

Enable full visibility of requests with our Tax Office Tracker

1591884120001

VATConnect Analytics is designed to give you full control, transparency and visibility of your data. Our new Tax Office Tracker expands that by providing a centralised hub on all requests from a tax office for any Foreign VAT applications we’ve submitted on your behalf. A query from a tax office in response to an application could be a request for additional documentation or additional information. Whatever the request might be, or the action that’s required, the Tax Office Tracker reports on that.

Here’s a video walkthrough of our Tax Office Tracker or you can scroll on down to read a more detailed guide

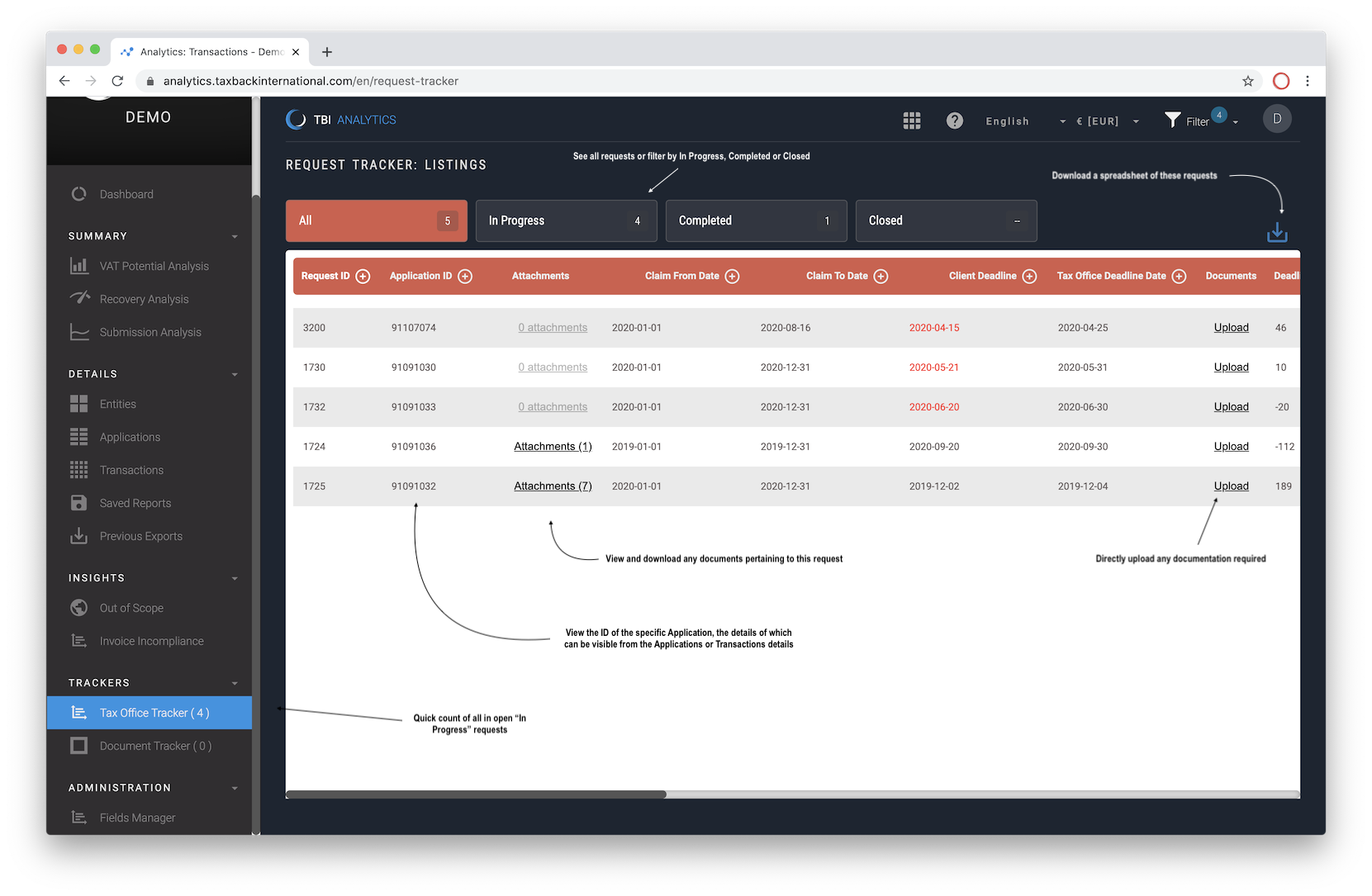

The Tax Office Tracker menu, on the left, provides a quick reference count of any open or In Progress requests. The Tax Office Tracker itself enables one to, at a glance, see what those queries are, what action is required and when that action must be taken.

From here one can download any documentation associated with this request, directly upload any additional documentation or download a complete spreadsheet of all the requests and associated details.

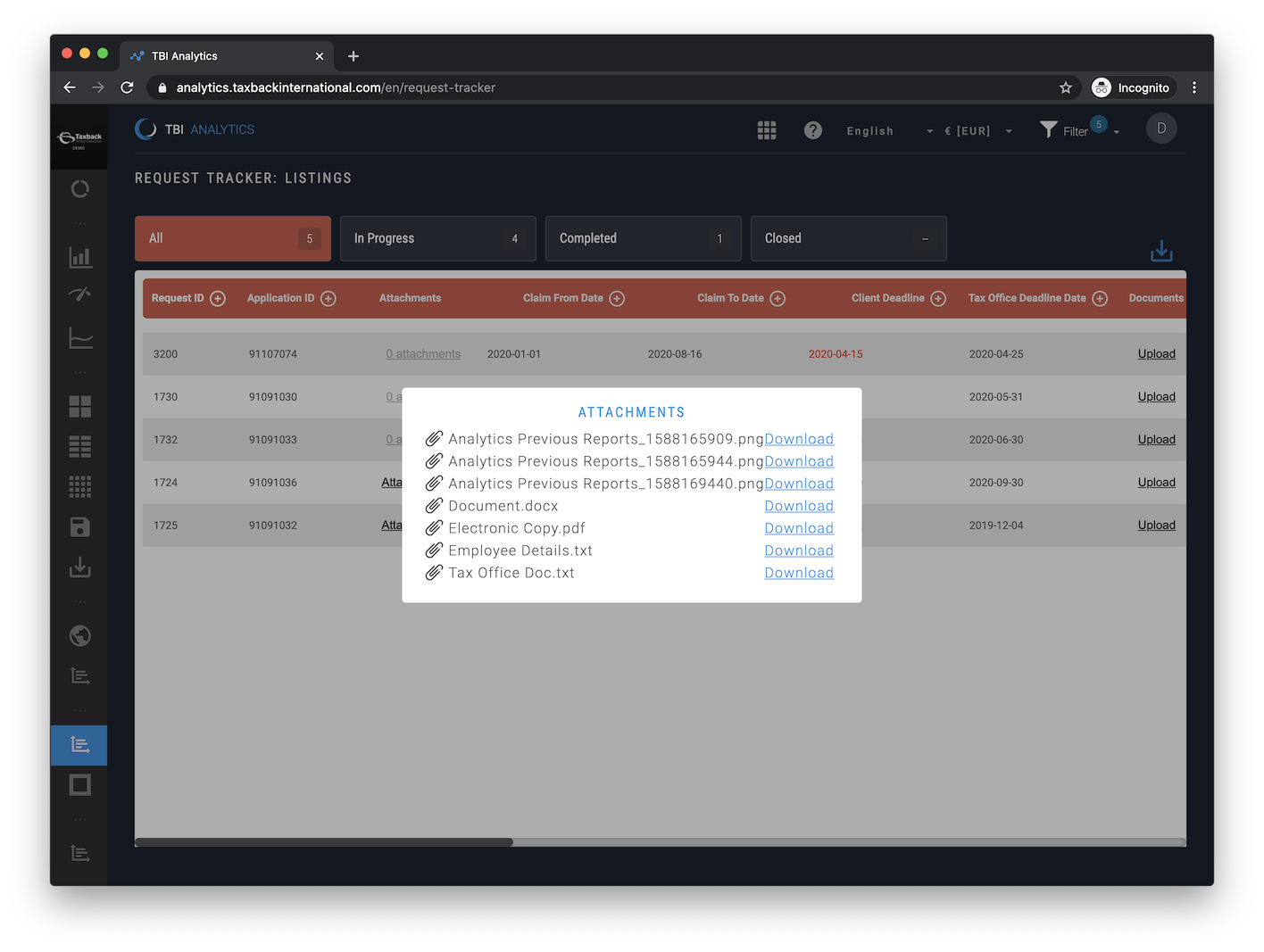

Clicking on the Attachments will provide a reference of all documents attached to a specific request, clicking on the file name will trigger a direct download of that file.

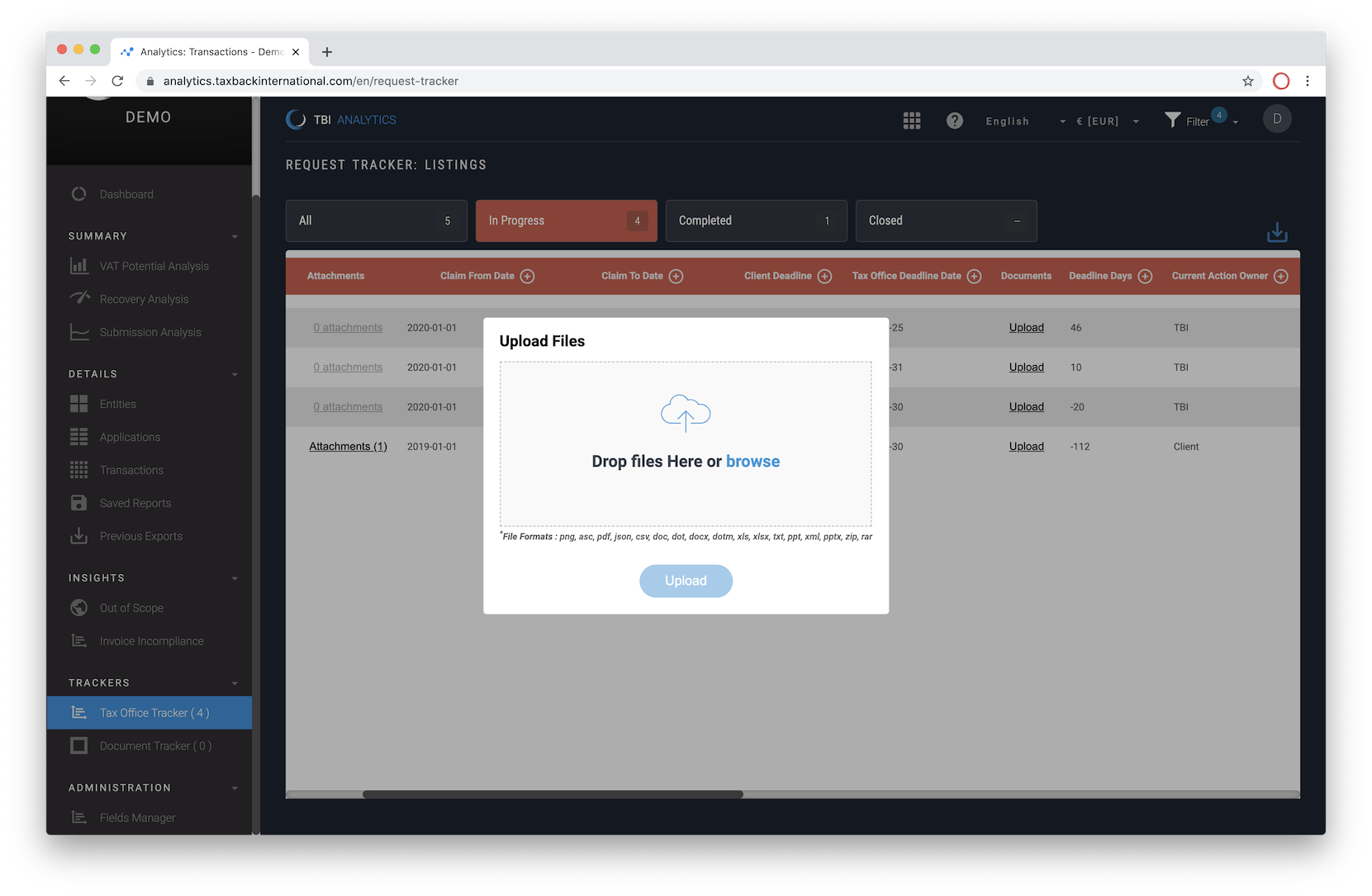

By clicking on Upload for a particular request one can quickly and easily upload documentation (of many different file formats, simply by drag and drop) directly back to the request (which are automatically added to the attachments view).

Clicking on the Export option allows one to download an Excel or CSV file of the requests. When the report is ready it will be emailed to the user who requested it directly and is available from the previous exports page too.

As with all areas in Analytics, if a user has access restricted to specific entities then so the Tax Office Tracker will report only on requests associated with those specific entities.

As always if you have any questions we would love to hear from you, reach to your account manager or contact us directly!