Getting Started with VATConnect Analytics

1591968780001

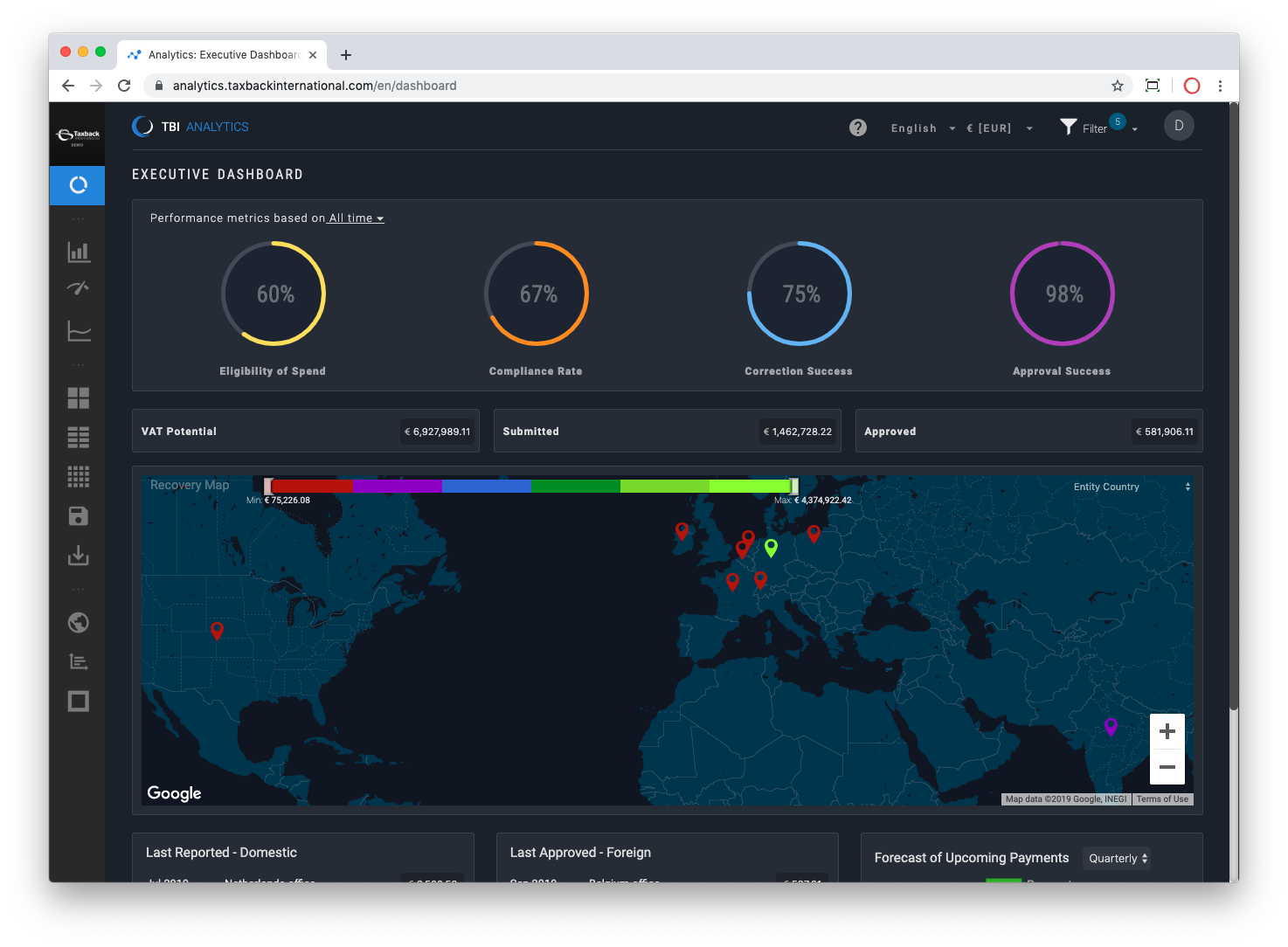

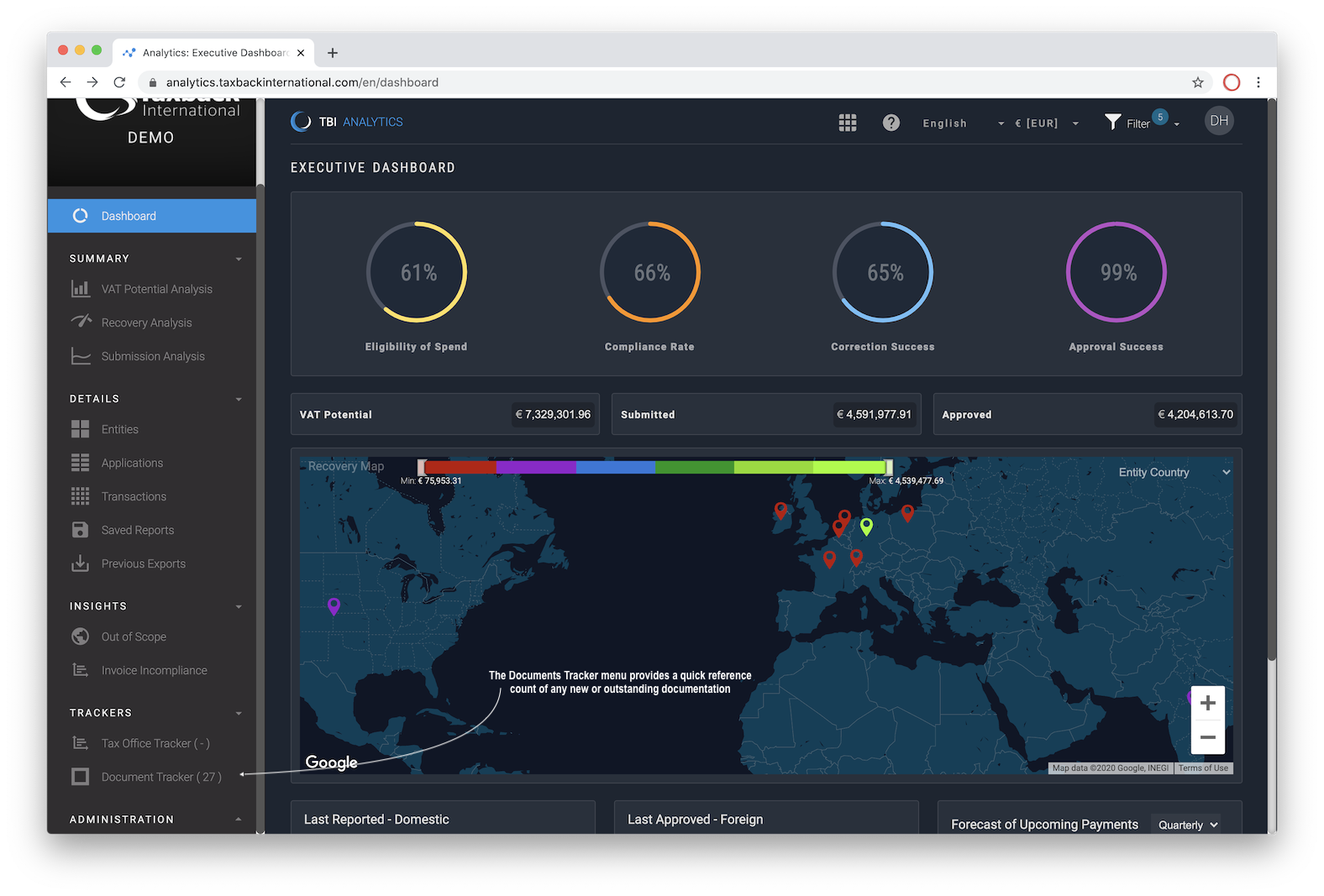

Welcome to our quick reference guide on using VATConnect Analytics from Taxback International. Our goal with Analytics is to provide you with complete control, transparency and visibility of our VAT reclaim process.

Here’s a quick intro video to VATConnect Analytics or scroll on down to read a more detailed overview.

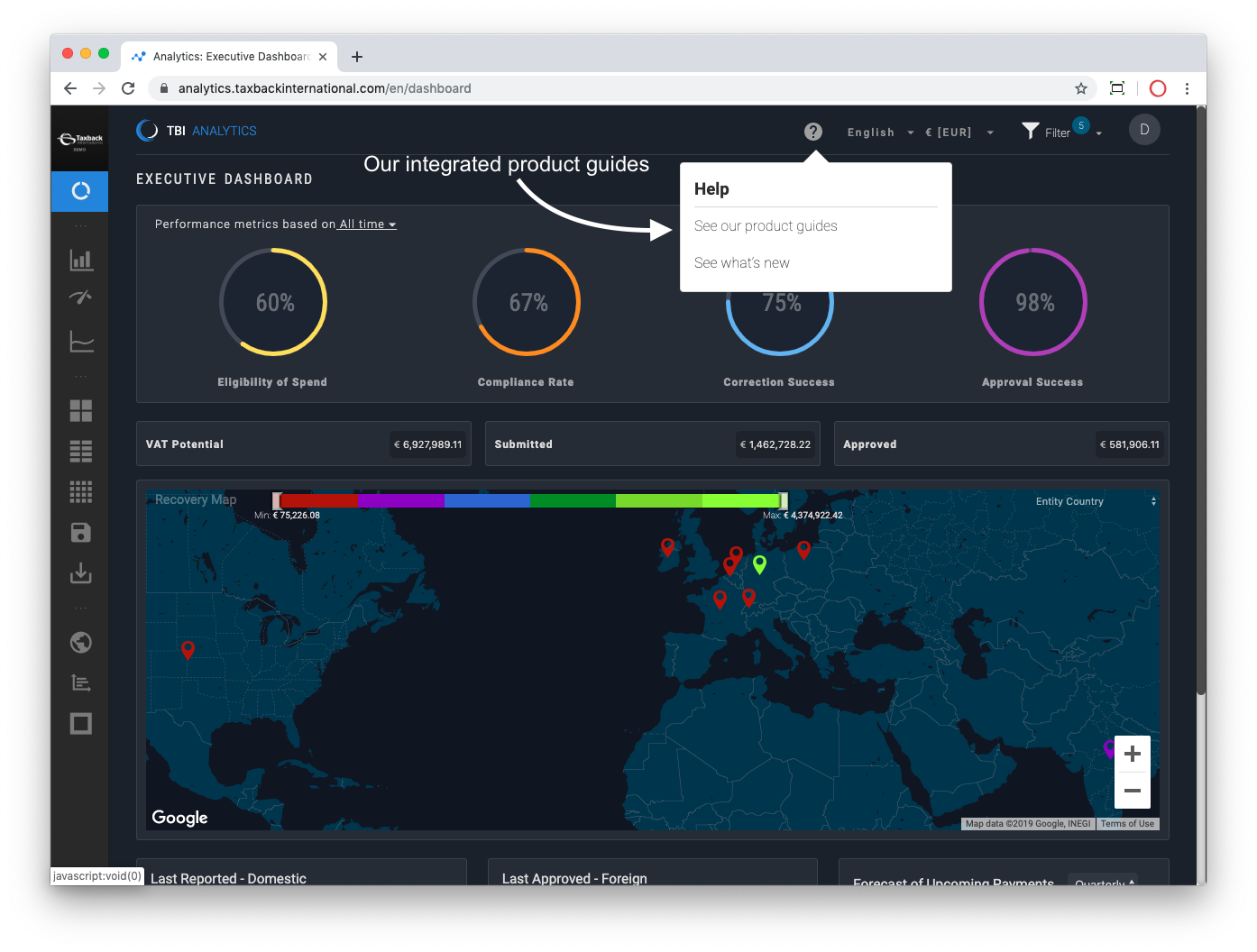

Whilst this article is intended to be a quick ‘Getting Started’ guide we also provide integrated product guides (walk-throughs) for each of the main areas of Analytics, you can access these by clicking on the Help icon and selecting the Product Guide you’re interested in.

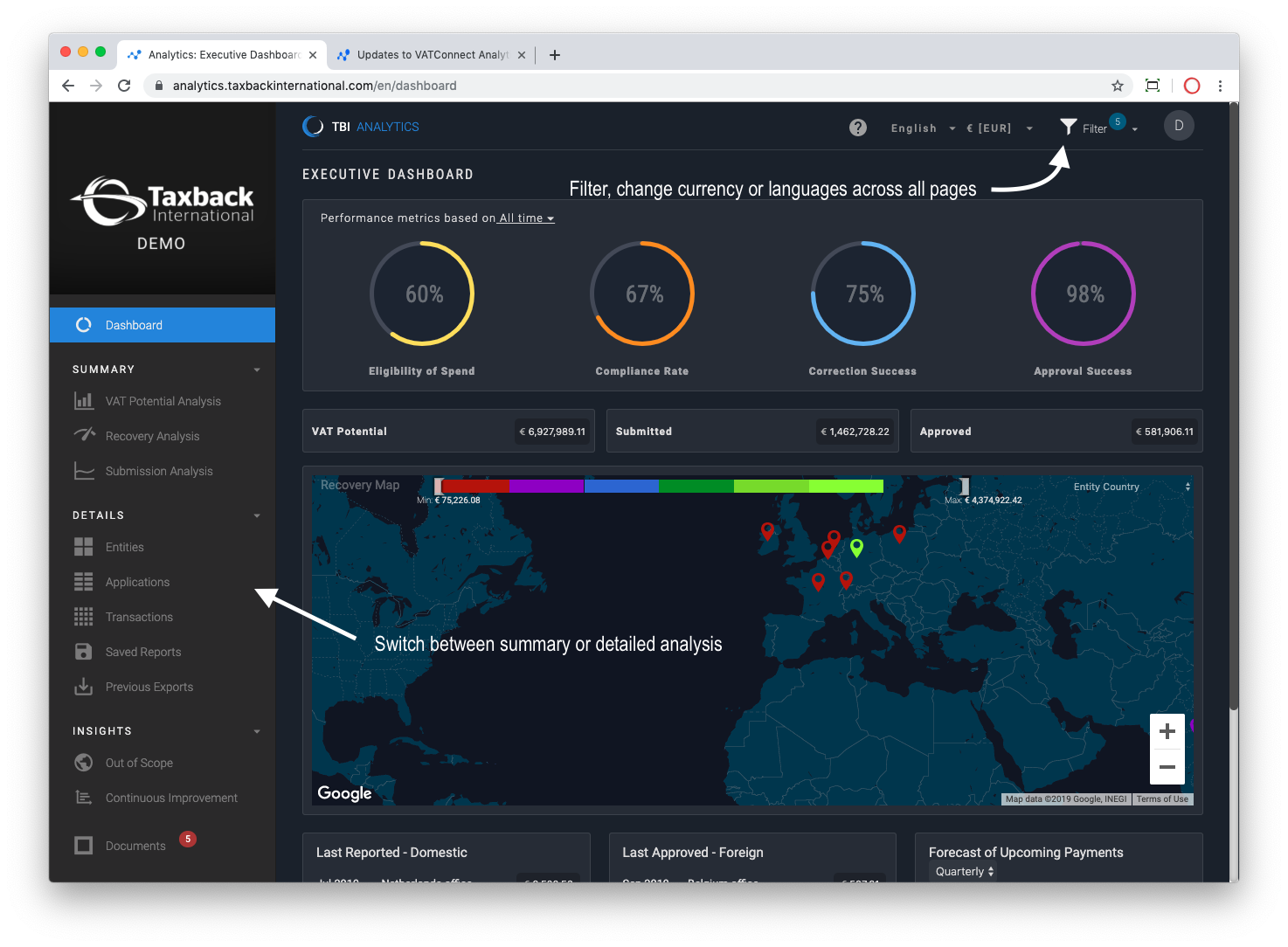

We broadly divide Analytics into five key sections:

The ‘Summary’ pages which provide a high level overview of each stage of the process

The ‘Details’ pages which drill into the transactional details of your spend

The ‘Insights’ pages which provide actionable insights into your data

'Trackers’, which centralises tax office queries into our Tax Office Tracker and Document Tracker which is a digital hub of your documentation

'Administration’, which provides administrative capability such as customising exports via the Fields Manager

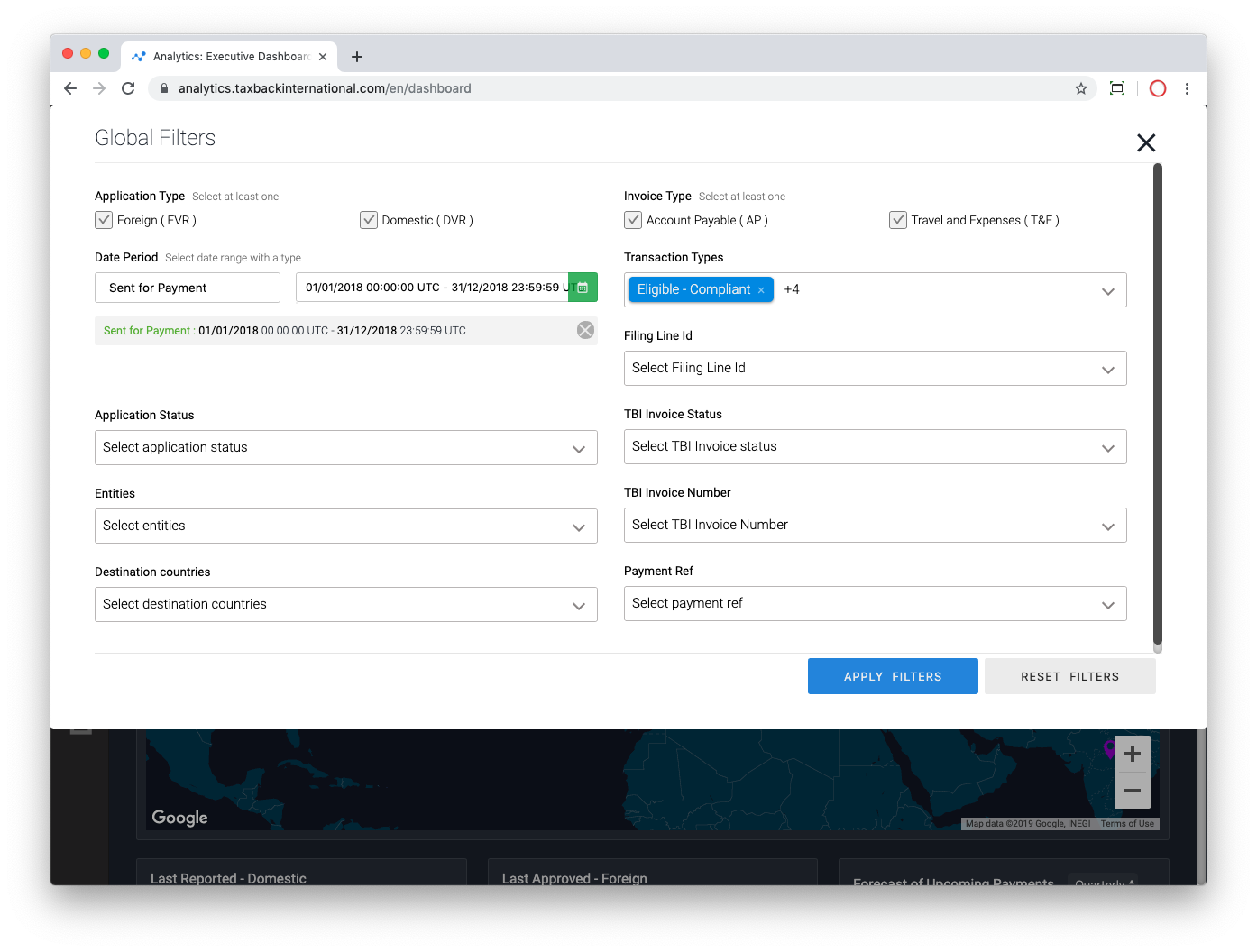

Within Analytics you can choose what language and/or currency to display in and which filters to apply, we call these the ‘Global Filters’ as they apply to all pages within Analytics.

There are default filters applied but you can choose what’s relevant to you, by default we’re showing data for transactions that were ‘Sent for Payment’ for any AP or T&E spend over the last 12 months. ‘Sent for Payment’ is the date at which the approvals process was completed for the expense or invoice.

If you ever you want to reset the filters back to their default state click on "Reset Filters".

The Summary Pages

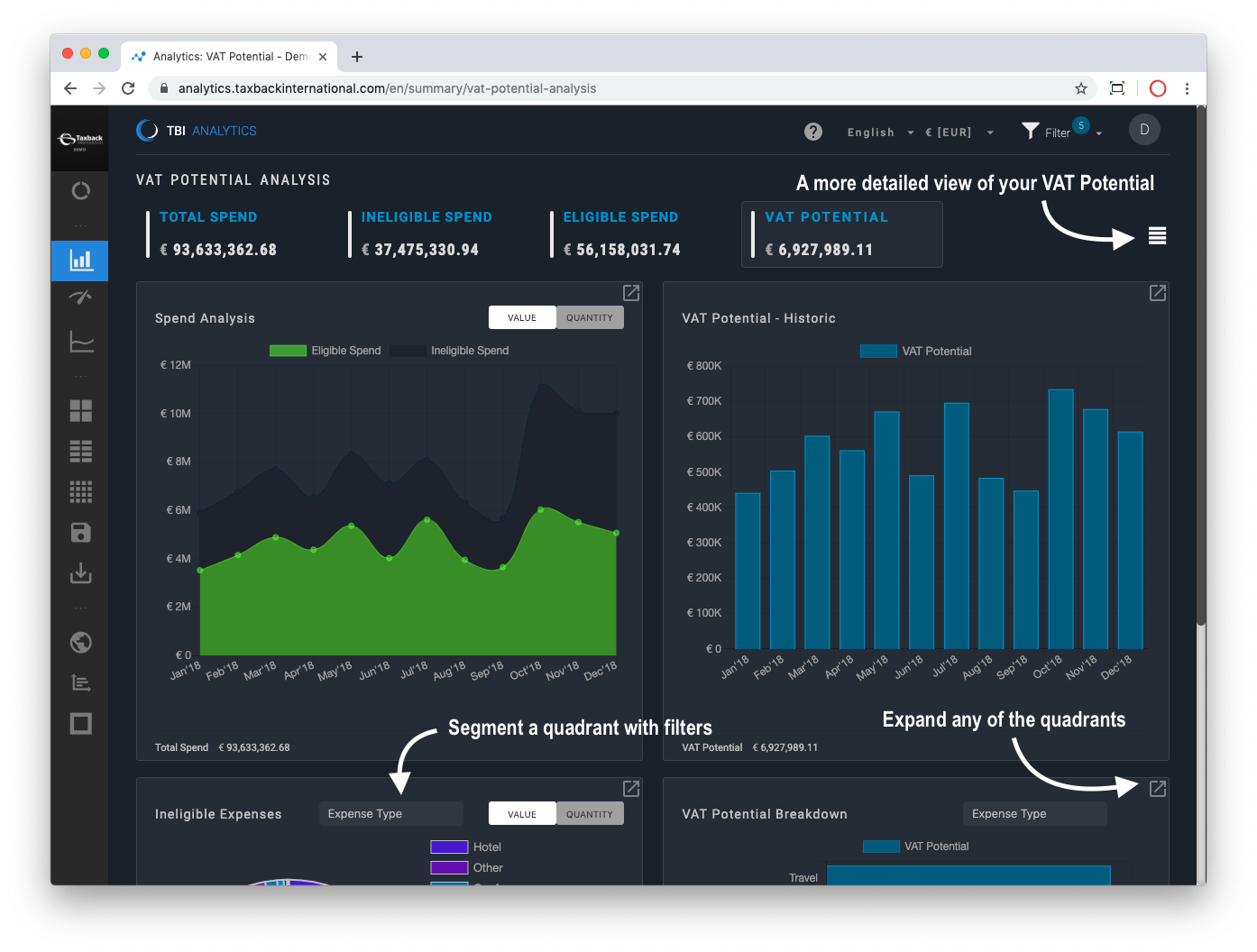

On all of the Summary Pages there are quadrants, most of these quadrants have individual filters across the top and all of the quadrants can be expanded or minimised.

The VAT Potential Analysis quantifies the potential VAT that’s reclaimable. Our Recovery Engine reviews every transaction to determine whether or not a transaction is eligible or not for VAT reclaim and of the eligible spend how much VAT is potentially reclaimable. That’s what this page shows here across the top, the quadrants below explore these metrics in greater detail.

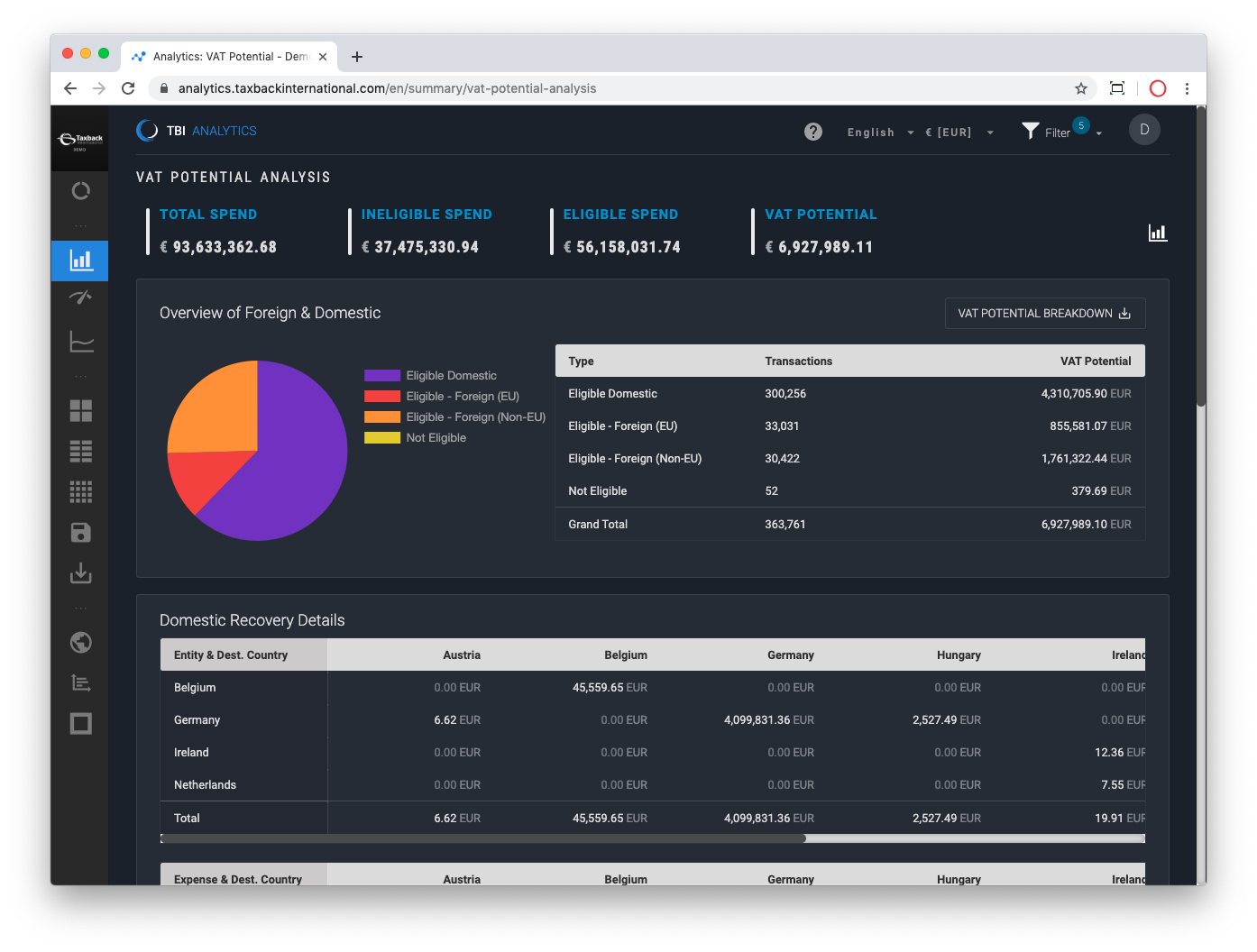

A more detailed view is available by clicking on the white icon on the top right, this is useful if you want to understand how much of that VAT potential is domestic or foreign spend and which entities are contributing to that spend.

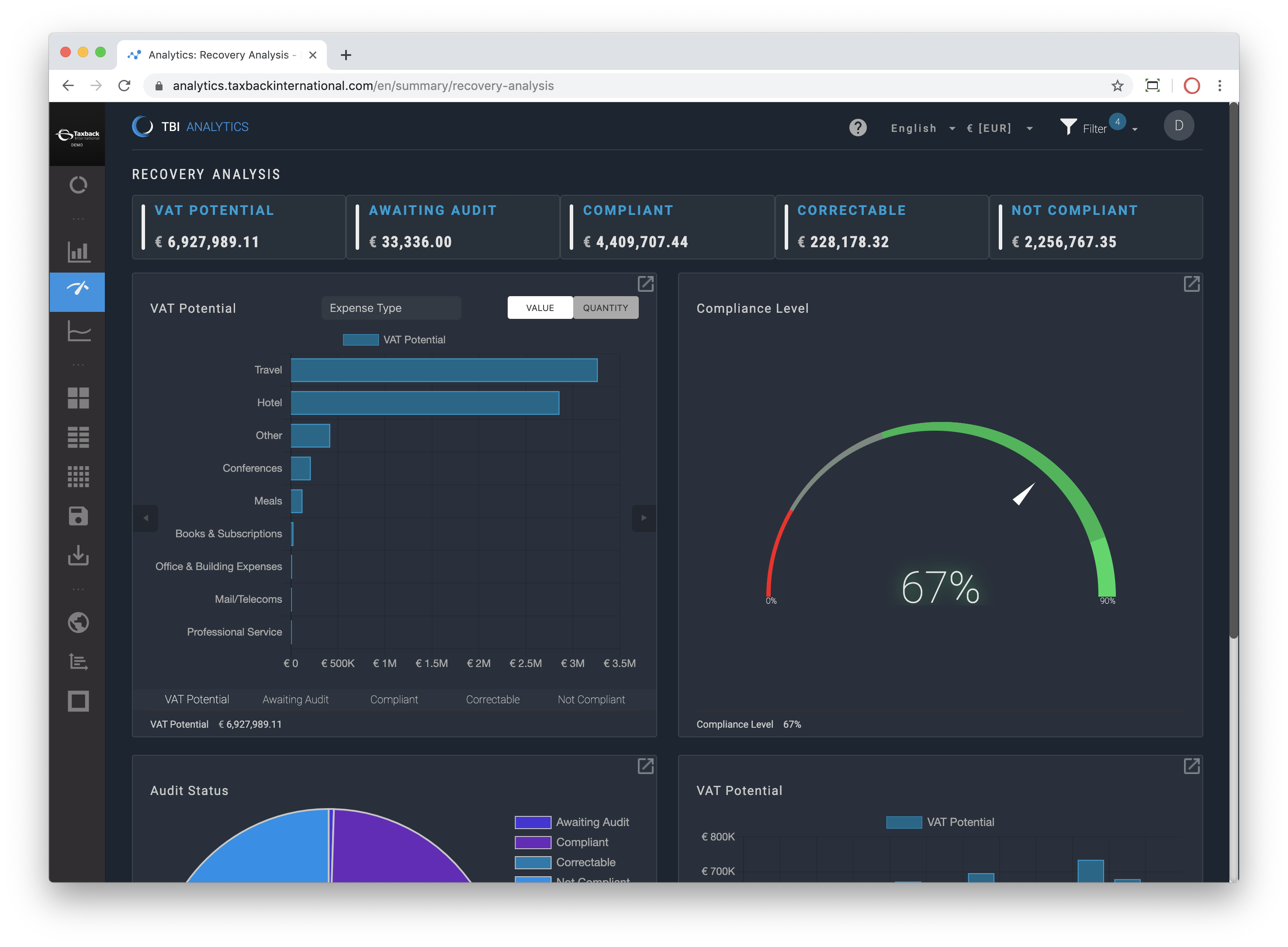

The Recovery Analysis validates how much of your VAT Potential is compliant or not for VAT reclaim. Our definition of compliant is whether the receipts or invoices attached to the invoice provide sufficient evidence of VAT being charged.

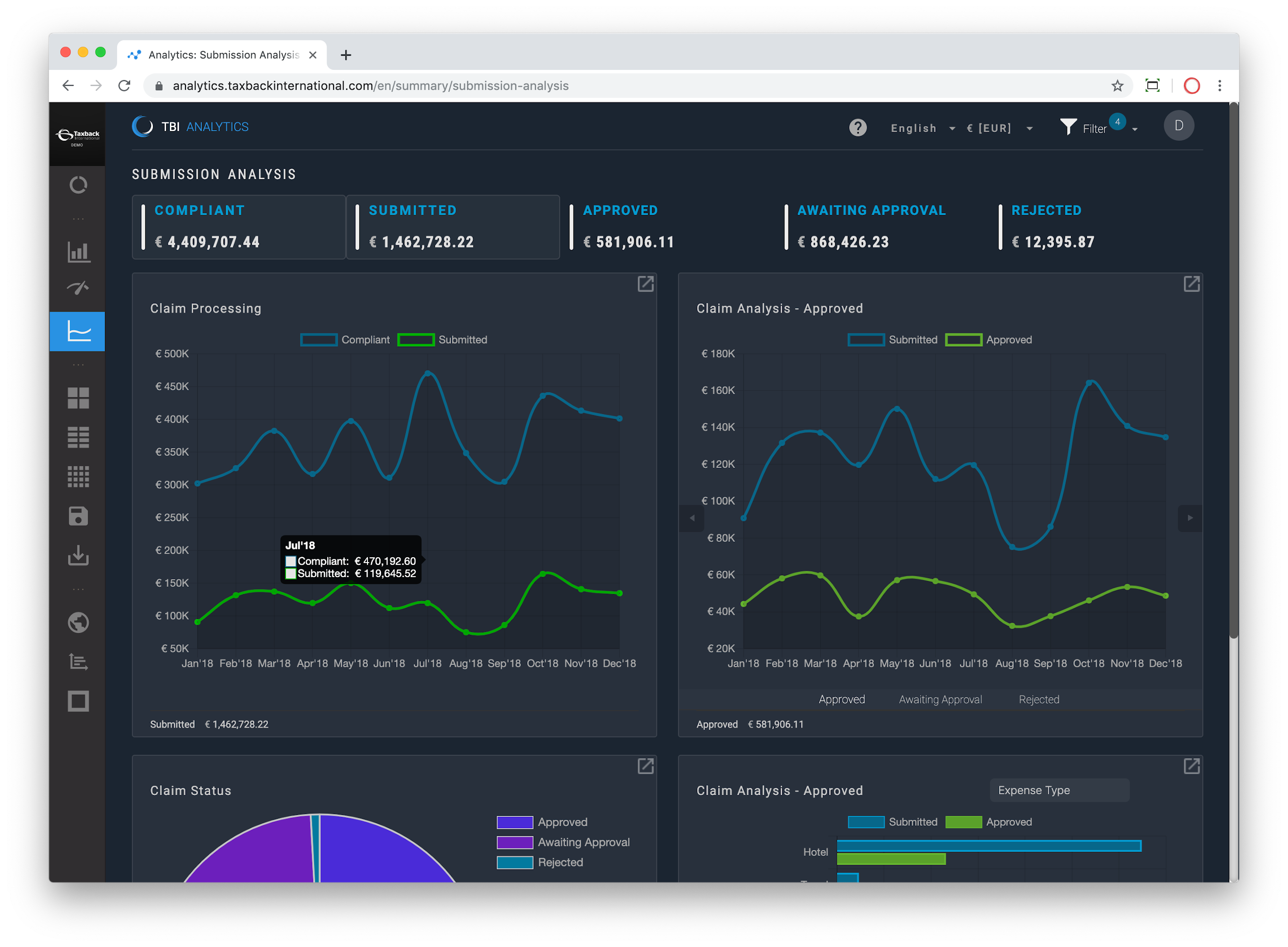

The Submission Analysis shows how much of the Compliant spend identified has been submitted to you, the customer (when the spend is domestic spend), or the Tax Office (when the spend is foreign spend) and of that submitted amount how much of that has been approved or has been submitted and is awaiting approval or has been rejected.

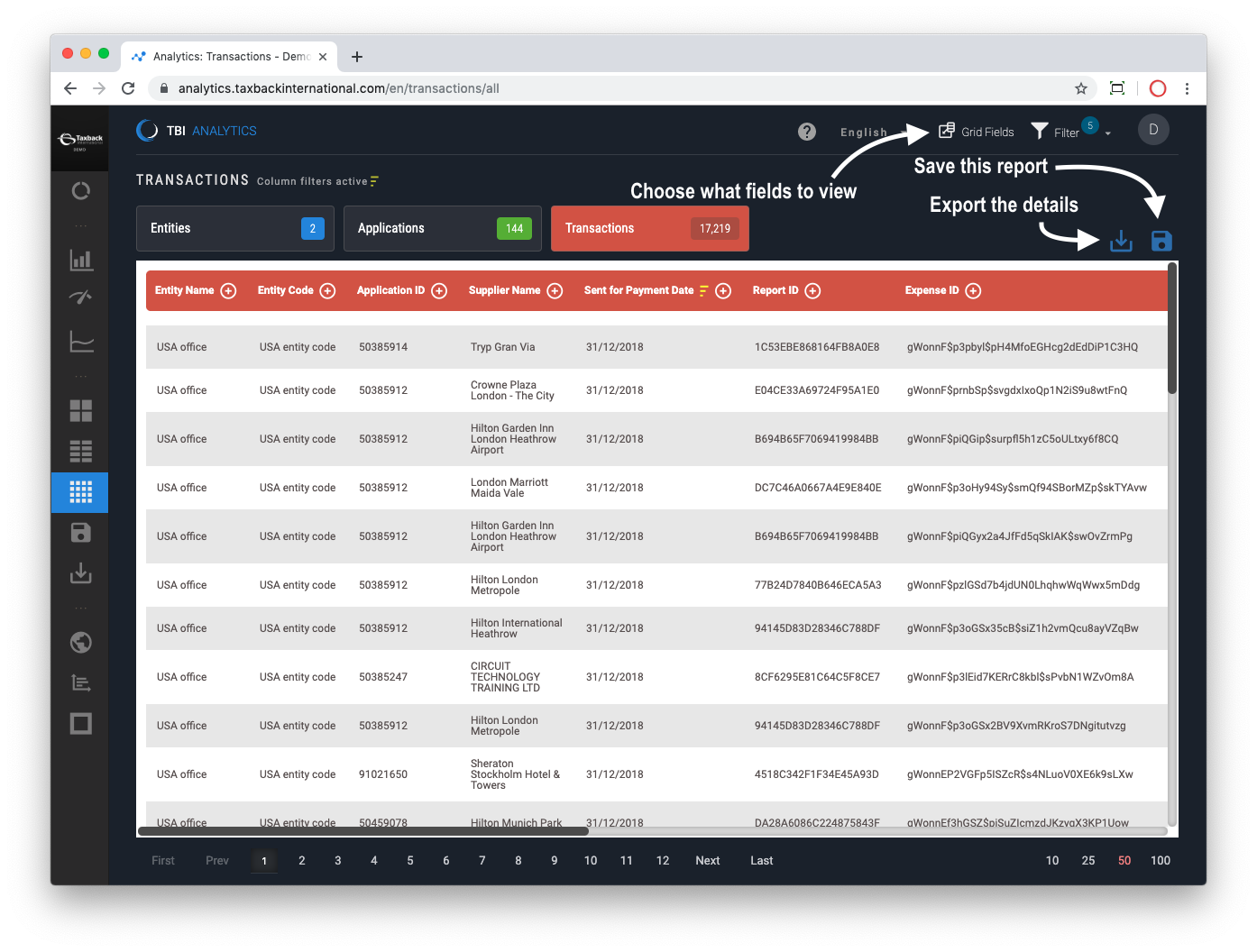

The Details pages provides all of the details into the summary pages, the most detailed view are the Transactions themselves, these are grouped into Applications and associated with Entities and are represented as three tabs on the Details pages.

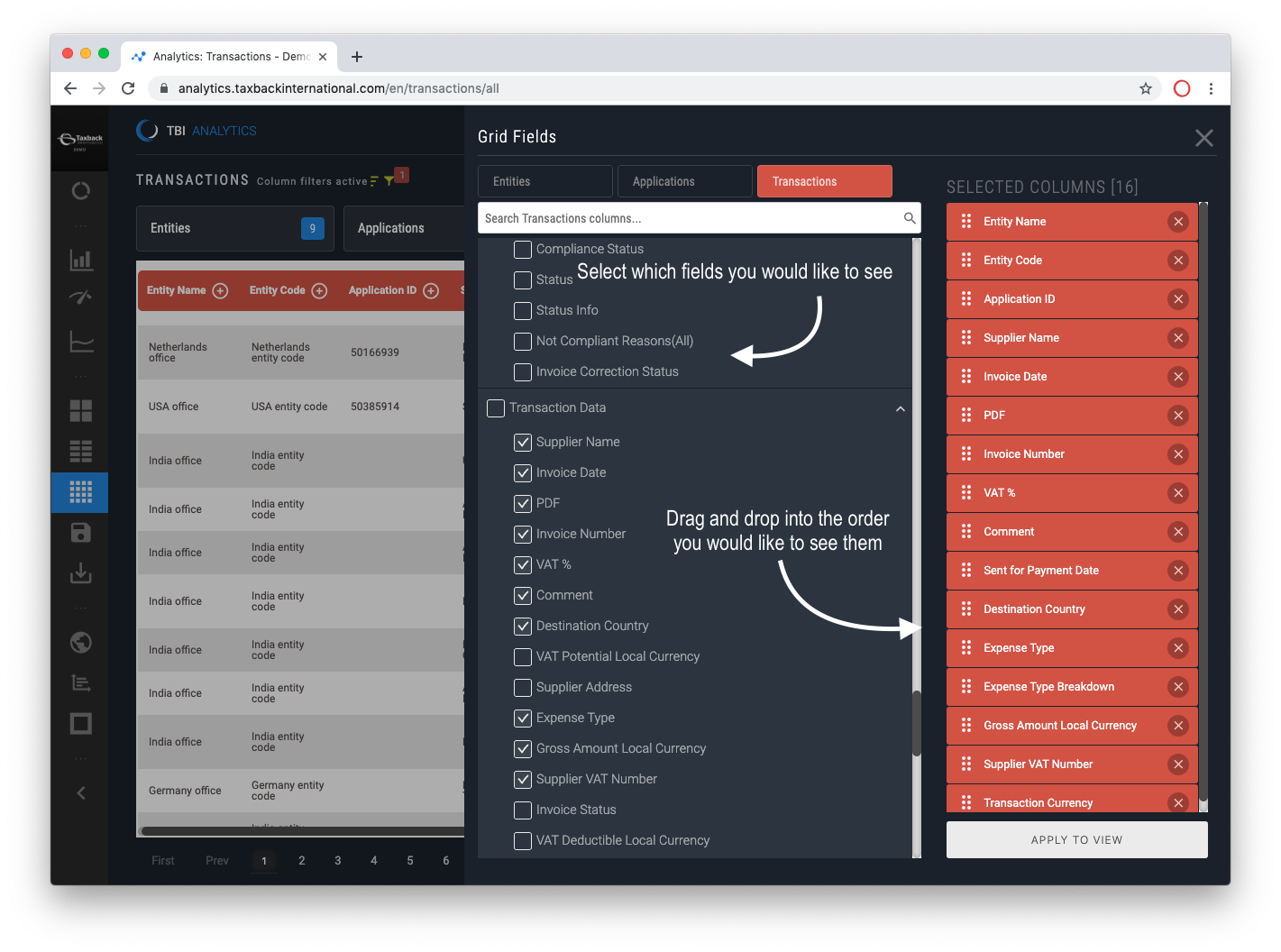

In these pages you can decide what you want to see and how you want to see it. In any of the grids (Entities, Applications and Transactions) you can choose which fields to add/remove from the view and the order of those fields. We wrote more about that feature here.

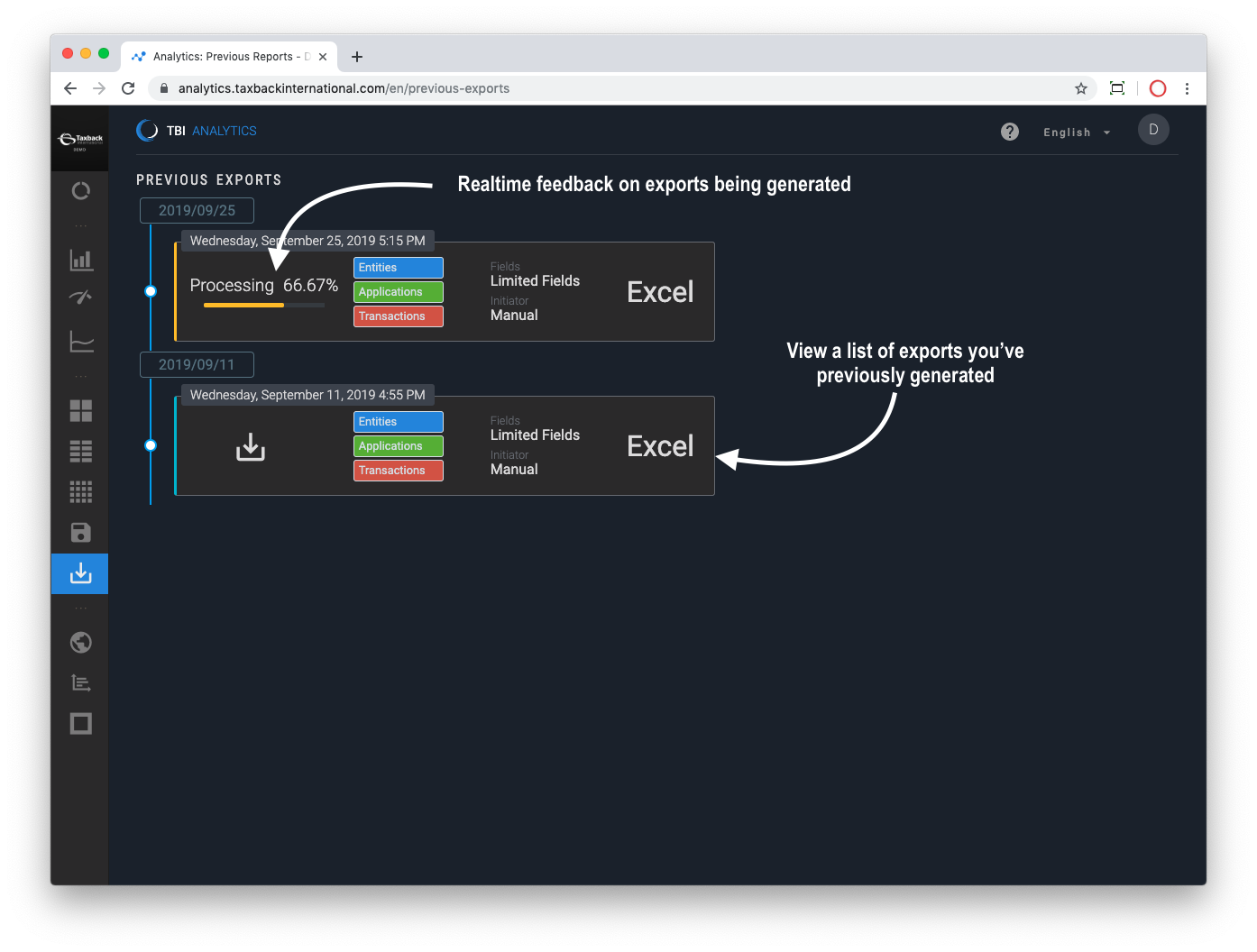

You can export that view into Excel or CSV, deciding whether you want to export all the fields or just the current view (what you’re looking at). You can read more about how to export from Analytics here.

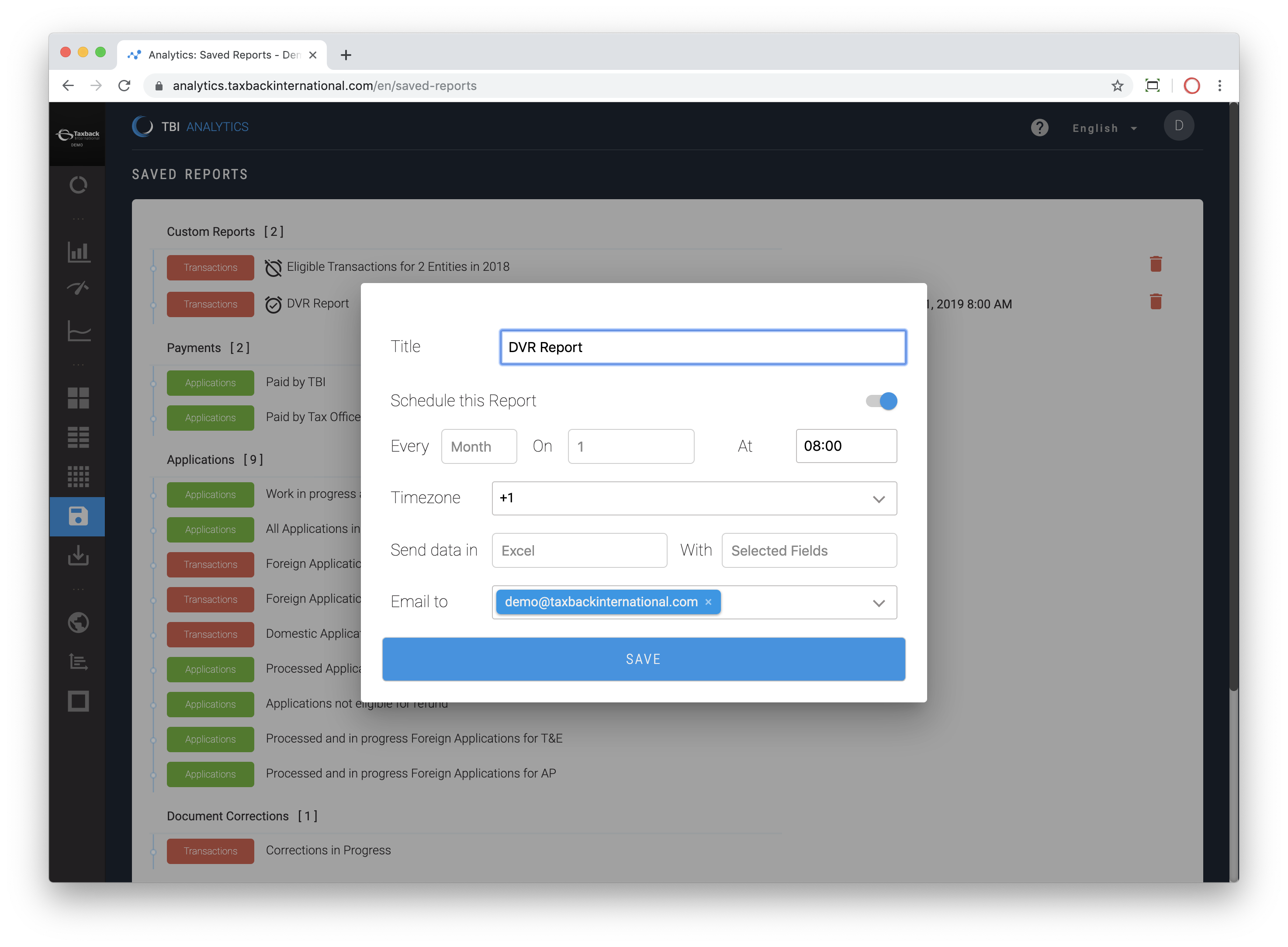

You can also Save the report so that next time you log in you can recreate the view from the Saved Reports link. Saving a report remembers the view you’ve created and the filters you’ve applied, all of these saved reports are accessible via the Saved Reports link.

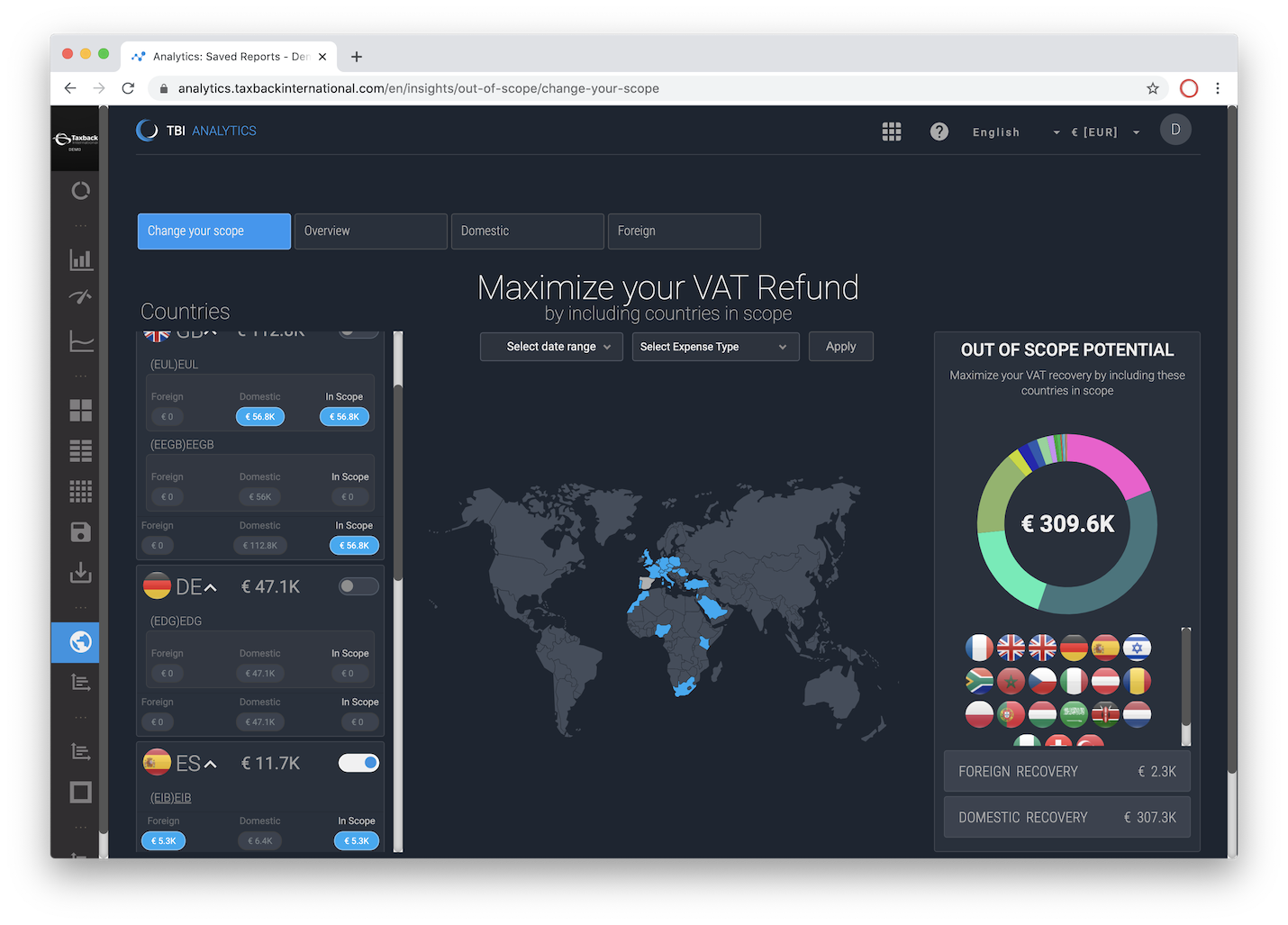

The Insights reports provides actionable insight into your data.

Our Out of Scope Insights quantifies, and within a click unlocks, the VAT Potential attached to spend that is currently out of scope for VAT Reclaim with Taxback International.

To learn more about Out of Scope Insights read our more detailed guide here.

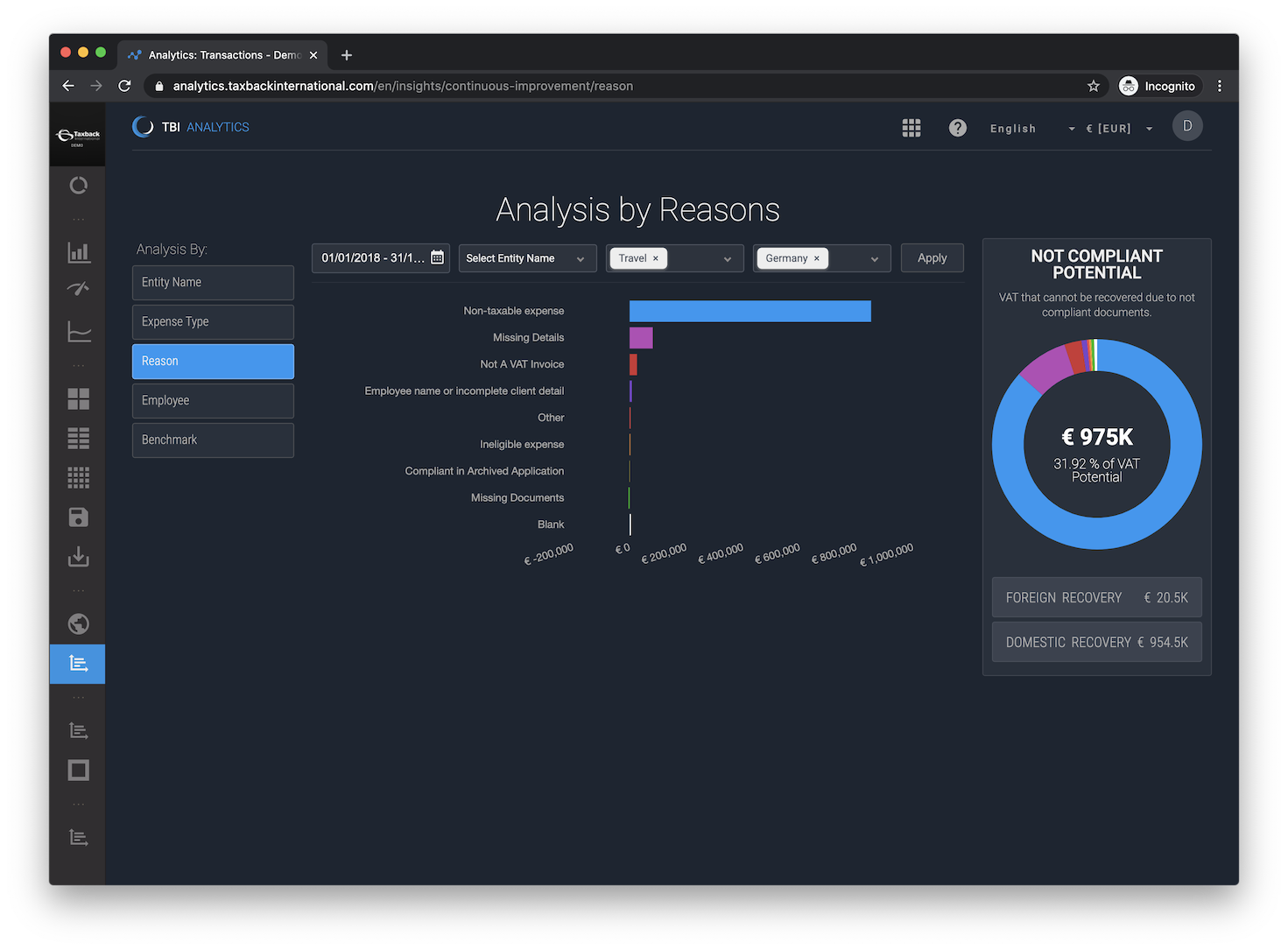

Our Invoice Incompliance report adds a new level of actionable insights, enabling one to forensically analyse what’s driving invoice incompliance. Our goal is that by specifying and quantifying the root causes of invoice incompliance we can enable action and measure the impact of those actions over time.

To learn more access our Invoice Incompliance insights read our more detailed guide here.

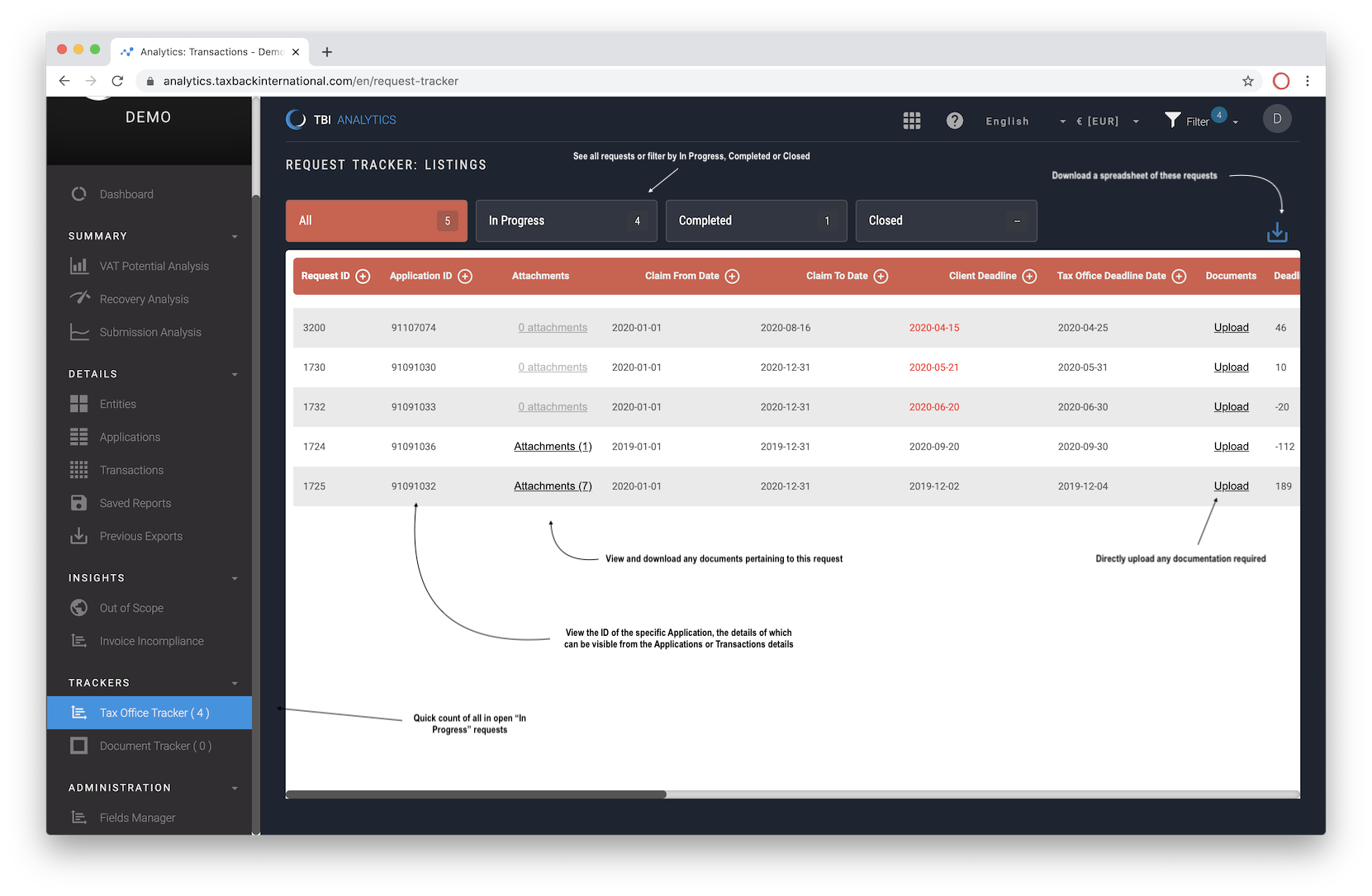

The Trackers menu centralises tax office queries into our Tax Office Tracker and Document Tracker which is a digital hub of your documentation.

Our Tax Office Tracker provides a centralised hub on all requests from a tax office for any Foreign VAT applications we’ve submitted on your behalf. A query from a tax office in response to an application could be a request for additional documentation or additional information. Whatever the request might be, or the action that’s required, the Tax Office Tracker reports on that.

To read a more detailed guide of our Tax Office Tracker click here.

The Document Tracker centralises into a digital hub all your documentation necessary for implementing Foreign and Domestic VAT reclaim.

You can read more about it in our product walkthrough here .

In the Administration section we provide an advanced feature called The Fields Manager. Here you have complete control over what gets exported from Analytics. We’ve created a specific walkthrough of this feature here.

We hope this is a useful guide on getting started with Analytics, we’ll continue to add more guides which dive deeper into some of the key areas in the coming months.