Unlocking the VAT Potential for Out of Scope Spend

1591871100001

VATConnect Analytics is designed to give you full control, transparency and visibility of your data. Insights, within Analytics, aims to provide you with data about your data. Our Out of Scope Insights quantifies, and within a click unlocks, the VAT Potential attached to spend that is currently out of scope for VAT Reclaim with Taxback International. This guide is a quick walkthrough on how to use our Out of Scope insights. You can watch the video below or scroll on past to read our detailed guide:

Out of scope spend is defined as a transaction which is associated with an entity or an entity’s spend type that contains potential VAT which is reclaimable but presently out of scope (that is to say whilst the spend has VAT, which is still reclaimable, it is not yet being reclaimed by Taxback International).

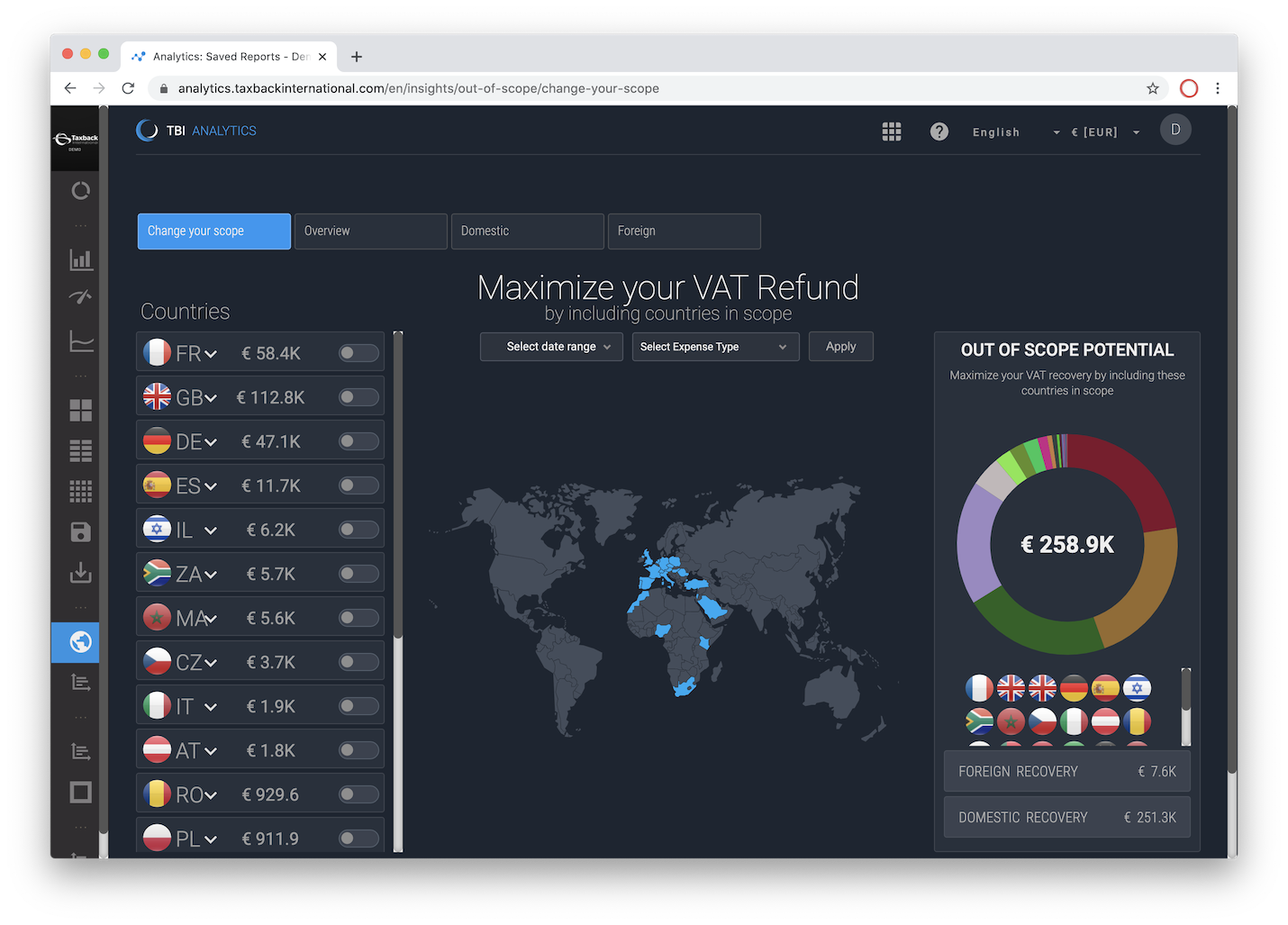

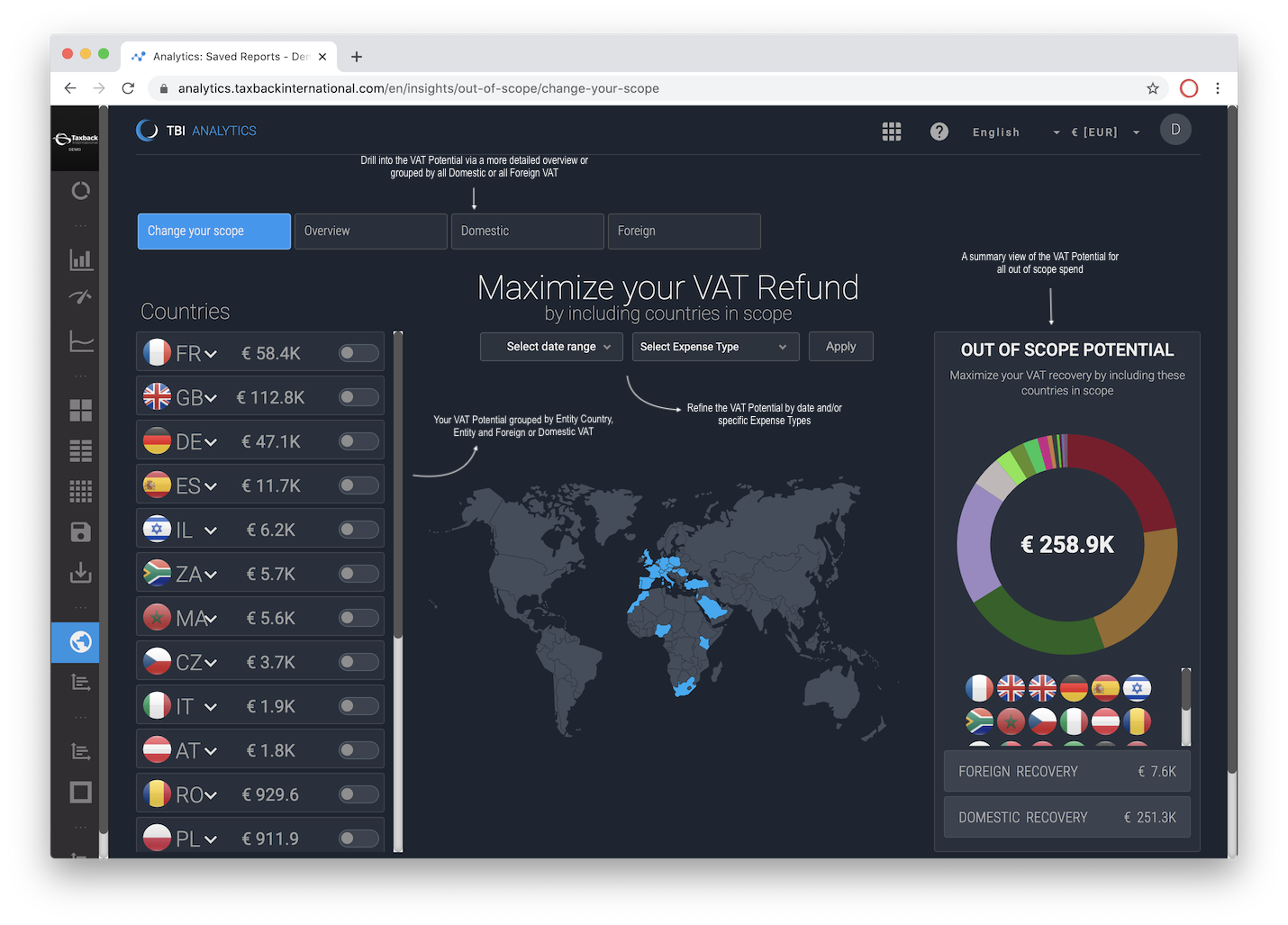

The Out of Scope insights presents an overview of that VAT Potential. On the right is the aggregated amount of that potential further broken by Domestic and Foreign VAT. The map shows, indicated in blue, the geographic distribution of the VAT Potential in which countries the entity or entities reside.

On the left is the breakdown of those countries, sorted by the highest value first. Expanding each country will show an entity specific (identified by the Entity ID) view of that VAT Potential.

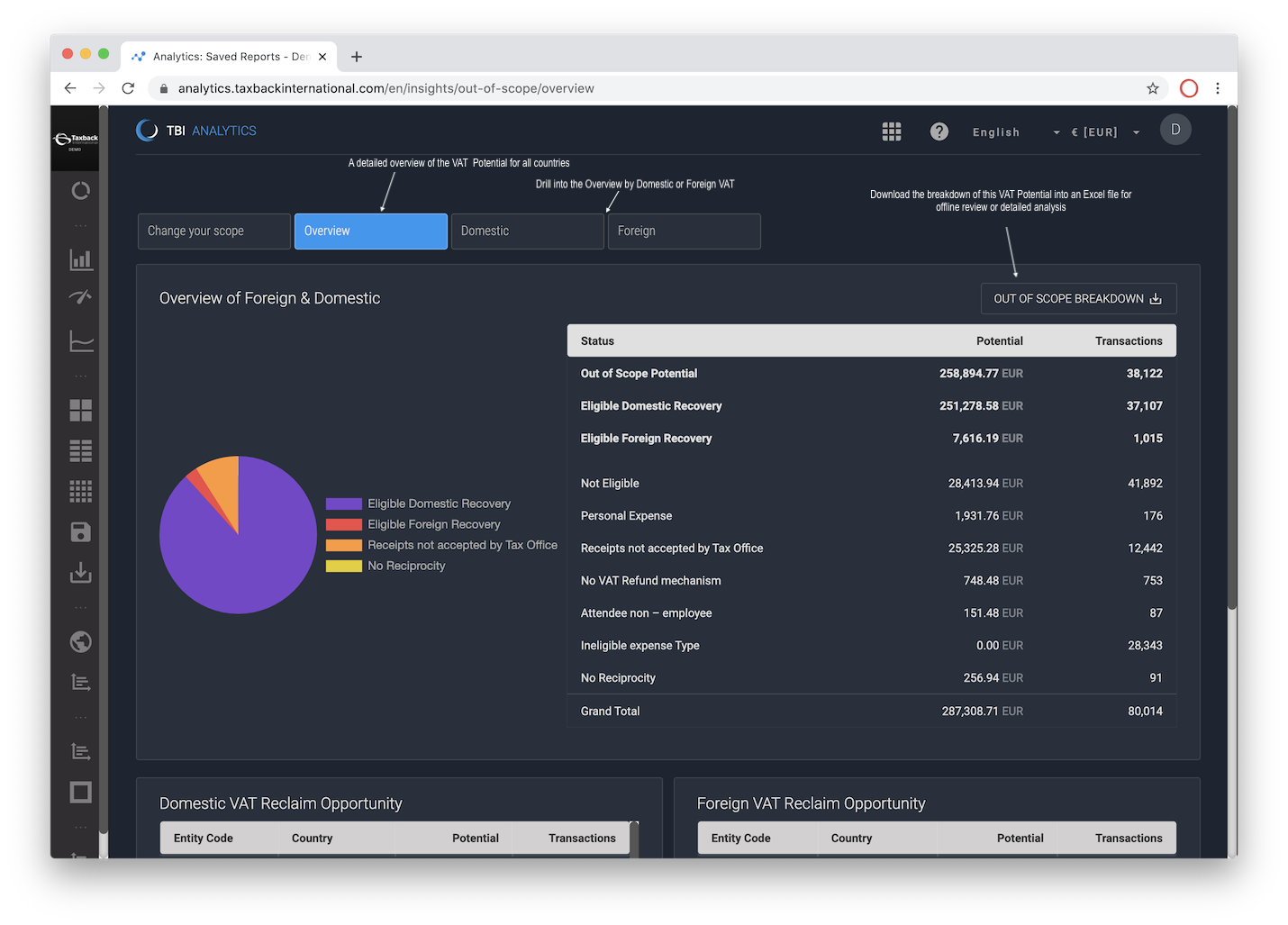

Clicking on the Overview tab drills into this VAT Potential. Here one can see, for all countries, the transactional count and value for Domestic and Foreign VAT. The quadrants at the bottom enable one to see that detail split by Domestic or Foreign, one can view only the Domestic or Foreign VAT by clicking on the tabs at the top of the page whereupon one is presented with a country and Expense Type breakdown. Each of these tabs (Overview, Domestic & Foreign) will respect whatever date range and/or expense type fillters were selected on the “Change you scope” home screen.

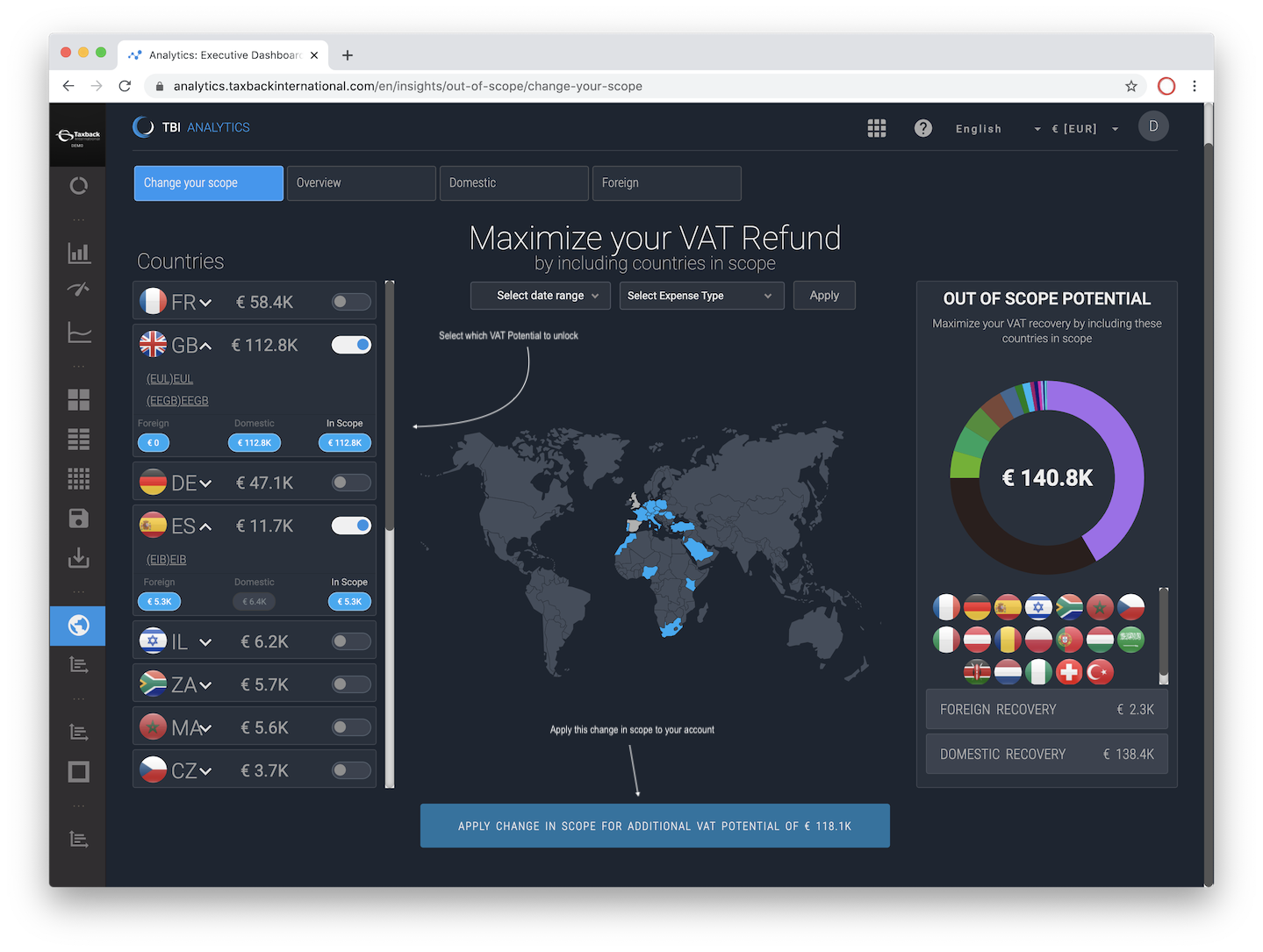

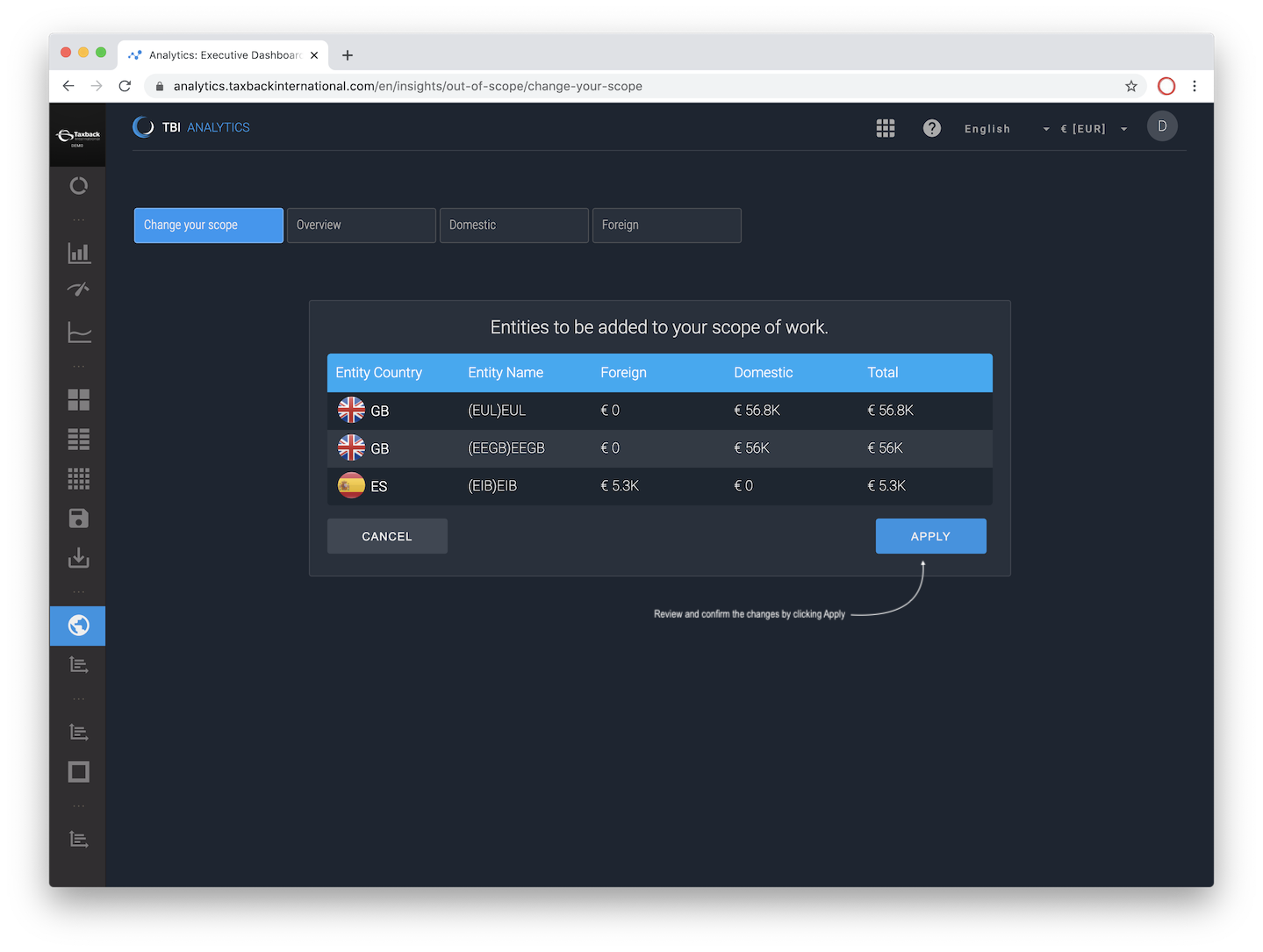

One can activate a change in scope by toggling on/off from the country level breakdown on the left (either the entire country, the specific entity within that country and/or specifically Foreign or Domestic VAT for that entity). To apply this change (to transition this spend into scope) simply click on Apply.

One is presented with a final breakdown of the changes before clicking on Apply. At this point an instruction is sent to our VAT Connect Intelligence to adjust a change in scope to your legal entity structure, the associated transactional data is then processed by our technology and Analytics is enriched with this new detail. A member of our implementation team would then reach out to you directly to walk you through the next steps.

As always if you have any questions we would love to hear from you, reach to your account manager or contact us!