Using our centralised hub of documentation with our Document Tracker

1592476080001

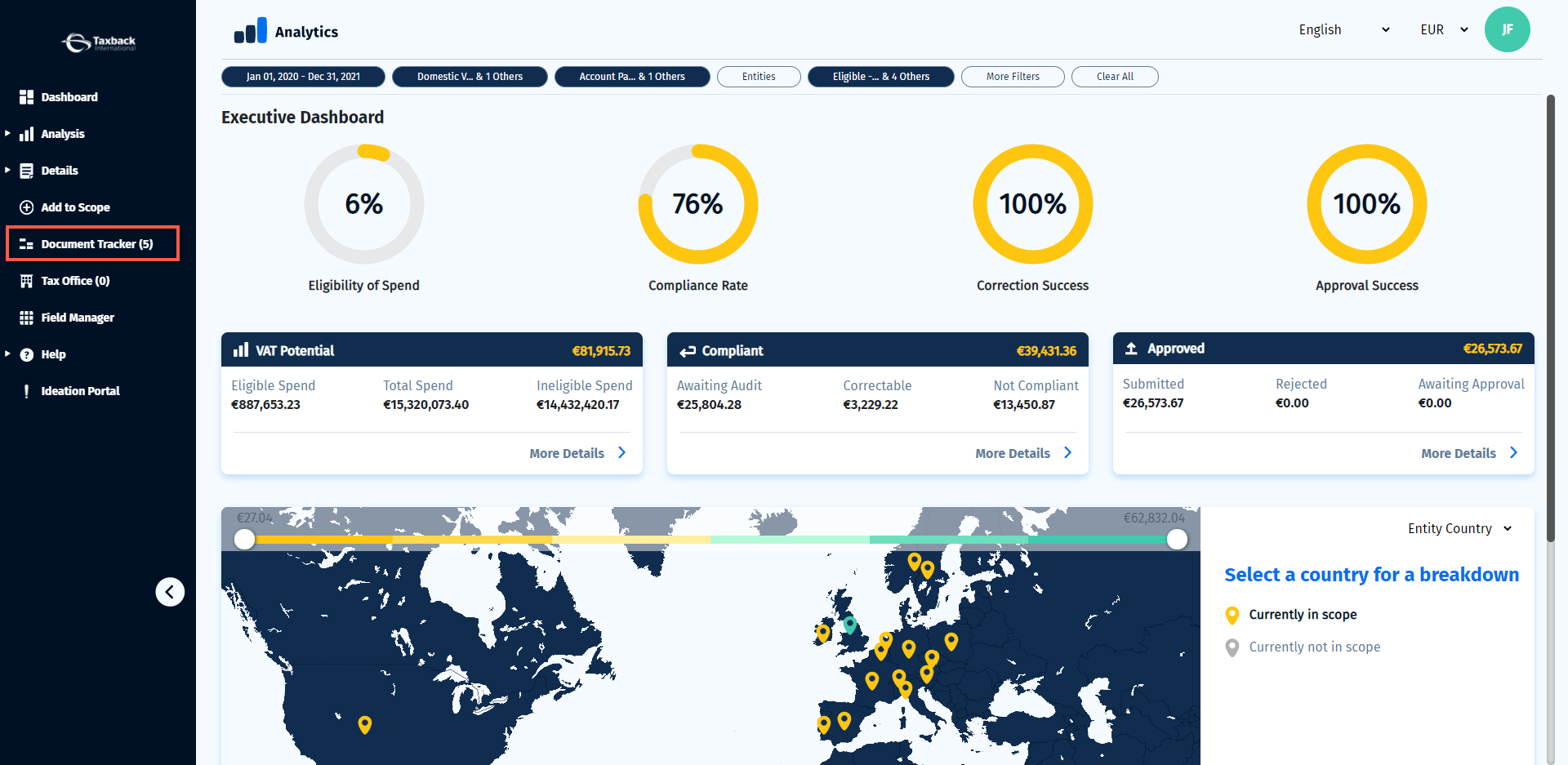

Our new Document Tracker, accessible from within VATConnect Analytics, centralises into a digital hub all your documentation necessary for implementing Foreign and Domestic VAT reclaim.

Here’s a video walkthrough of our Document Tracker or you can scroll on down and read a more detailed walkthrough.

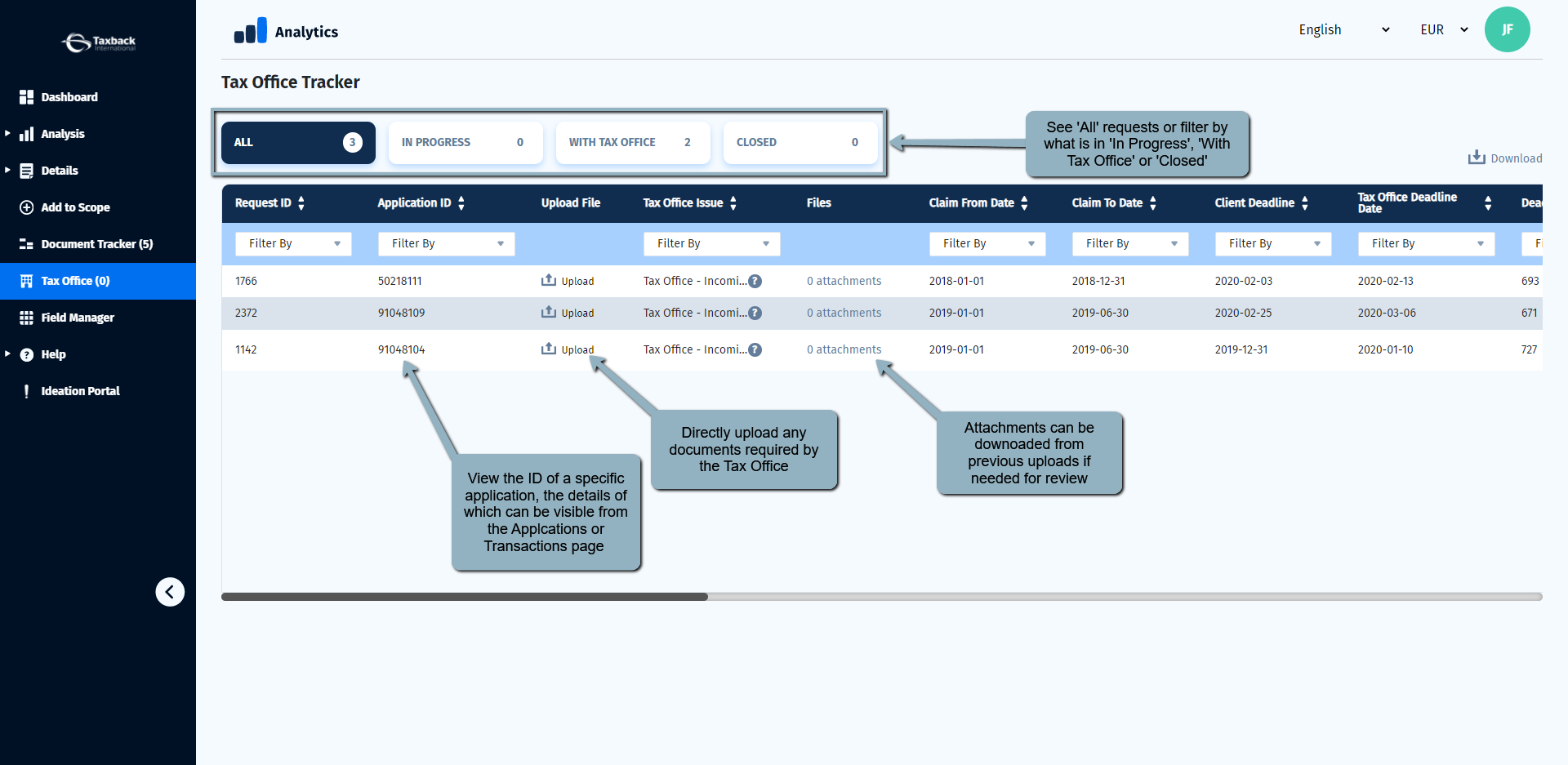

You can access Document Tracker from the Trackers option in your Analytics menu.

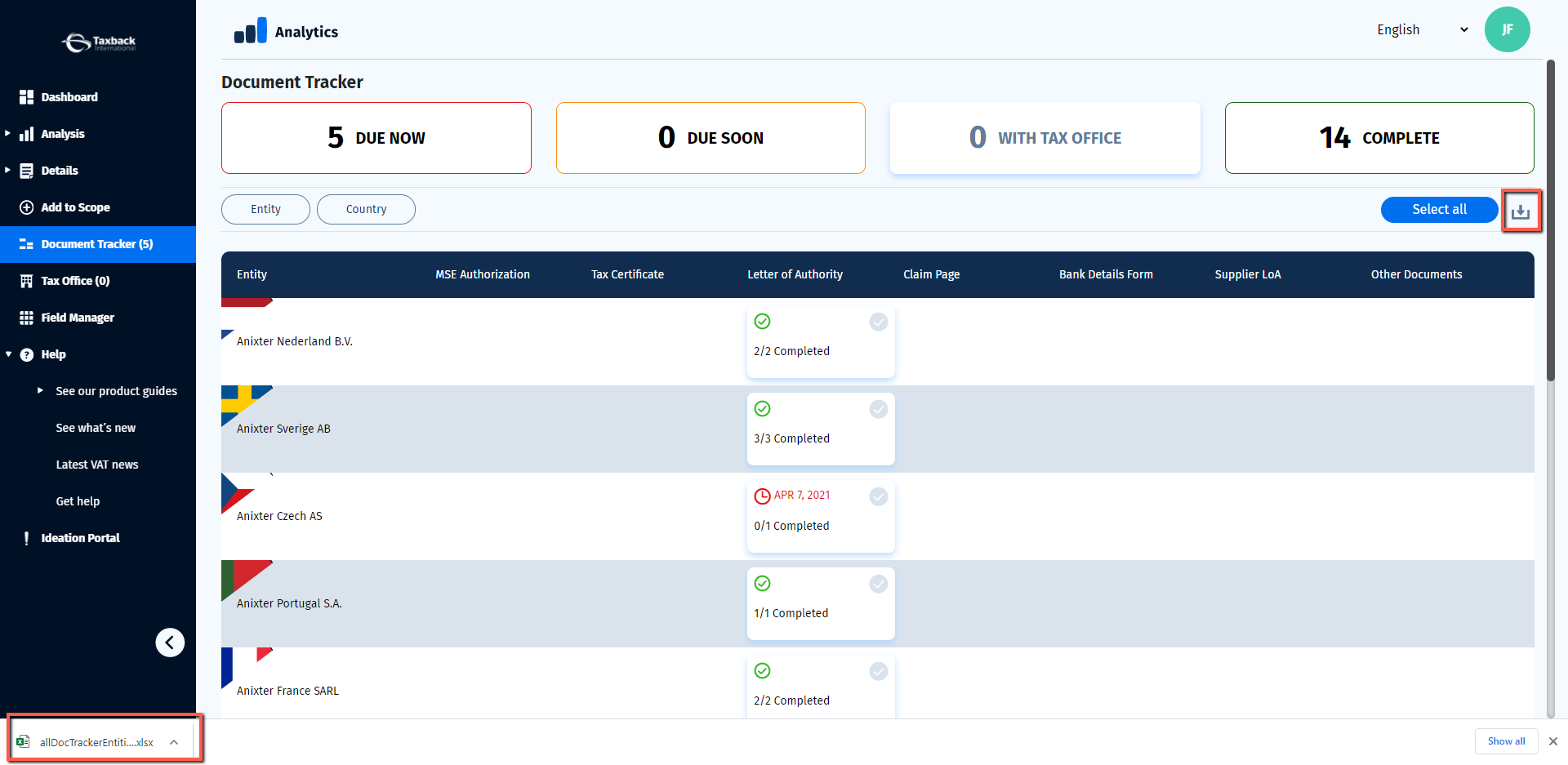

The Document Tracker counter I.e. Document Tracker (5) which is visible on the left Analytics menu provides a quick reference to any outstanding documentation.

As with every area of VATConnect Analytics restricted access is maintained, that is to say if a user has access restricted to specific entities then she shall only see within Documents Tracker documents pertaining to those specific entities.

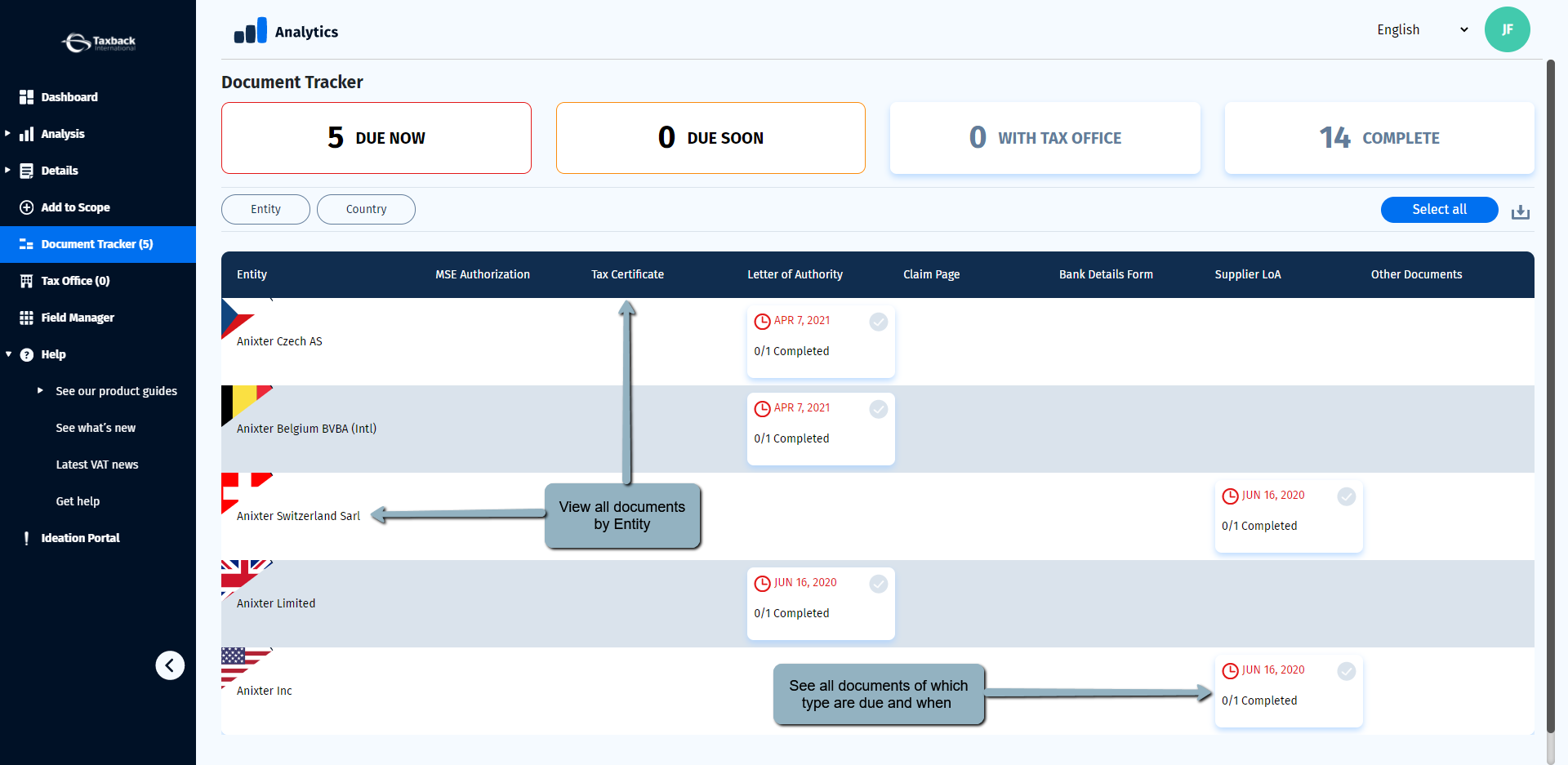

Within the Document Tracker one by default sees all documents due now grouped by entity and document type. One can additionally choose whether to show documents that are due later, are in progress with the tax office or are now complete.

The grid itself shows for each entity the document types in the form of a tile. Those tiles show how many are needed, have been provided and when they’re due (if the document is outstanding).

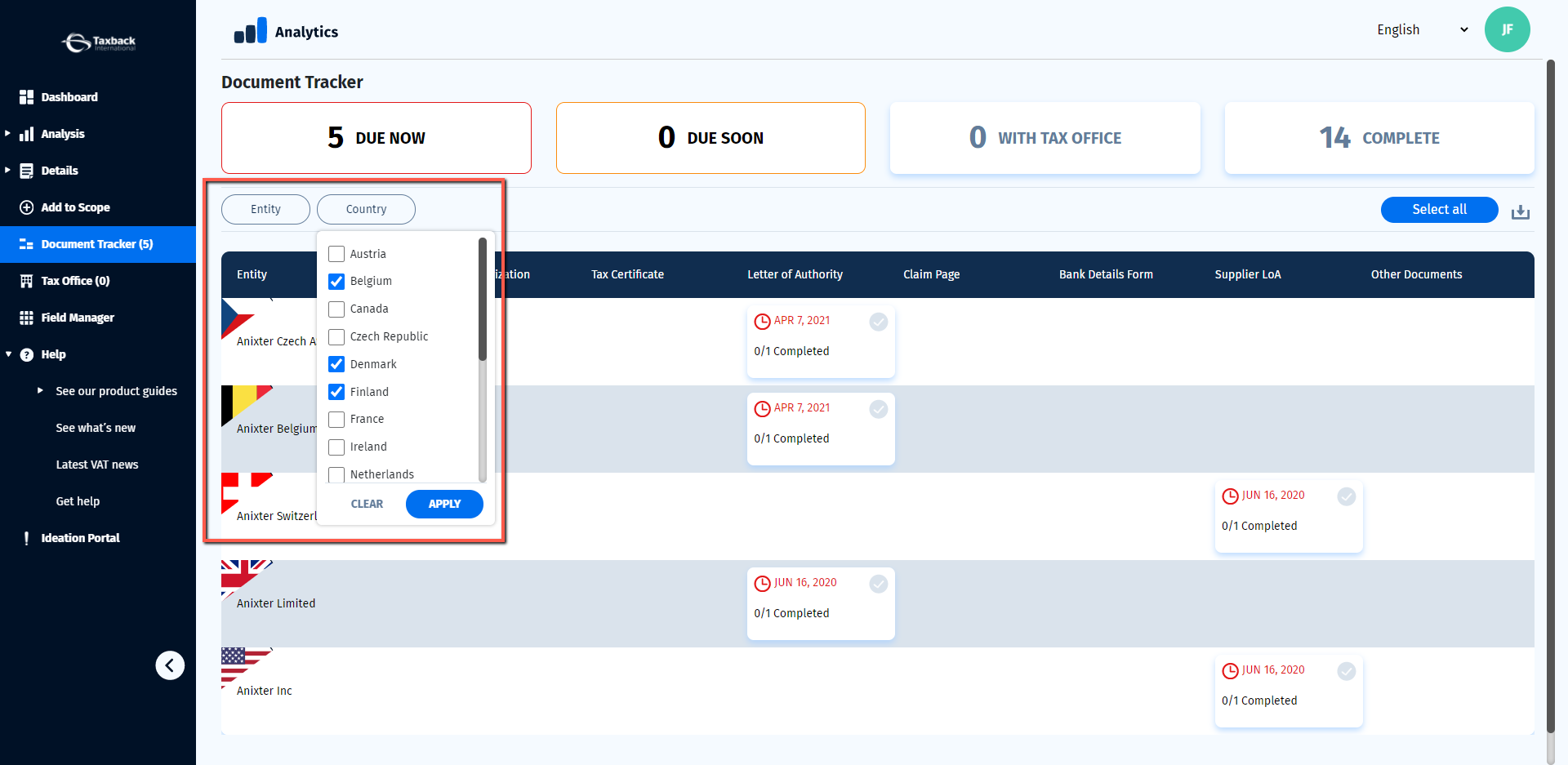

One can further refine that view by selecting documents for a specific entity or the country in which the entities are registered by applying additional filtering.

The download icon on the top right will generate an Excel spreadsheet of the current view should you wish to circulate a reference to other members of your team or have an offline reference file.

At a click one can download all the documents needed by selecting all or specific documents and selecting Download. Any document generated is pre-populated with the relevant information, all documents are compressed into a Zip file and a link is emailed to you directly when it’s available for download.

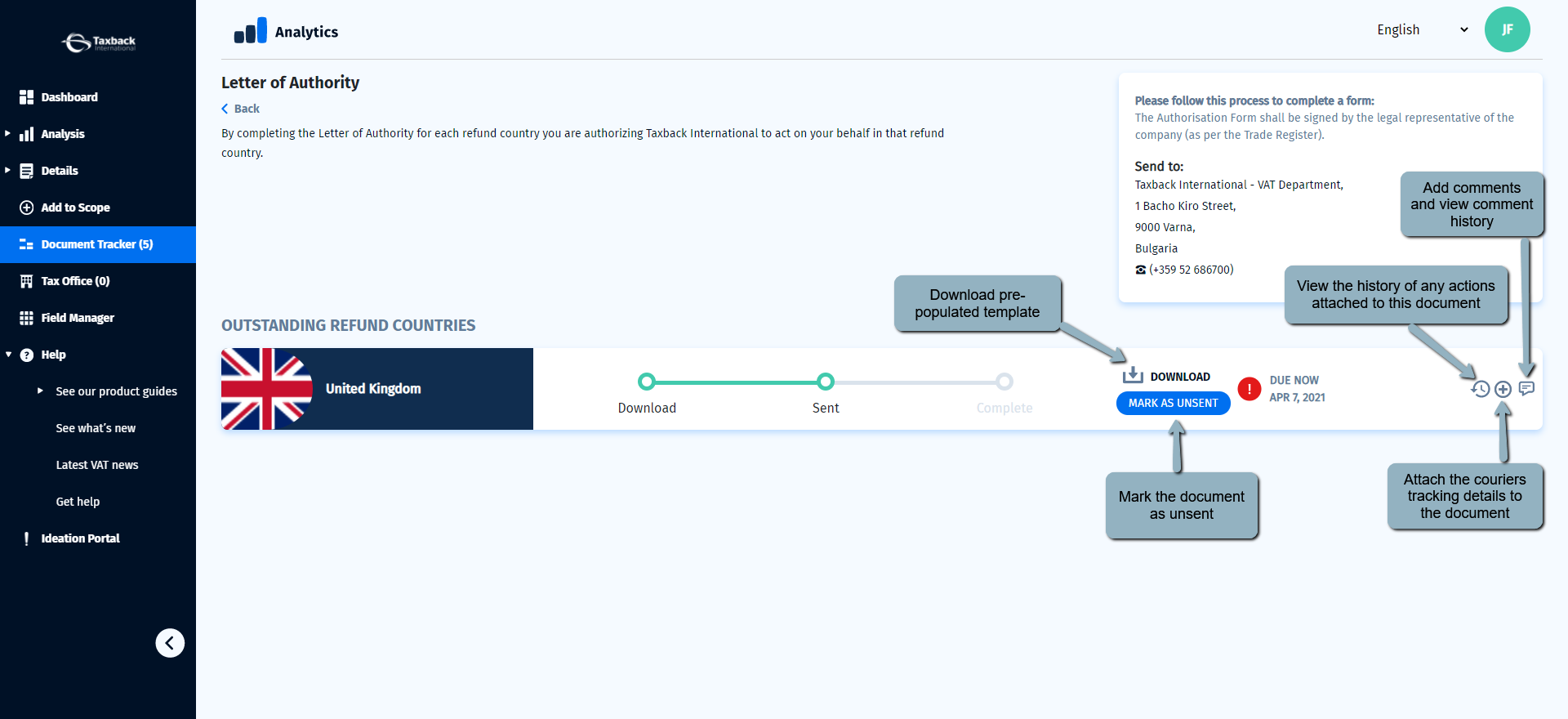

Clicking on any of the tiles for a given document which drill into more detail. In the example above one can see that for the US entity the Letter of Authority is outstanding for three countries and has already been provided for two. For any of the outstanding documents one can:

Download the specific pre-populated document

Mark the document as sent

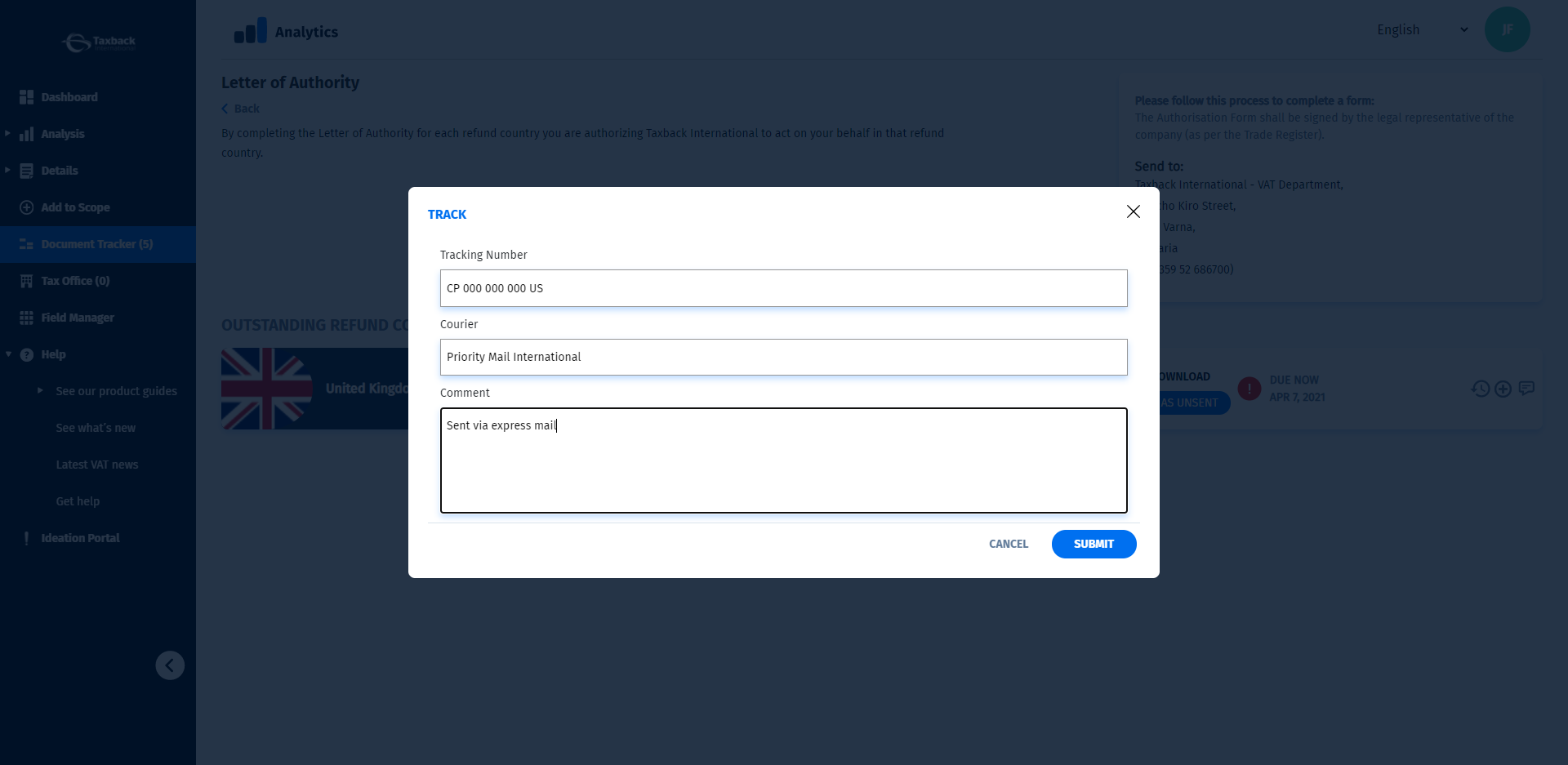

Attach the couriers tracking details to the document

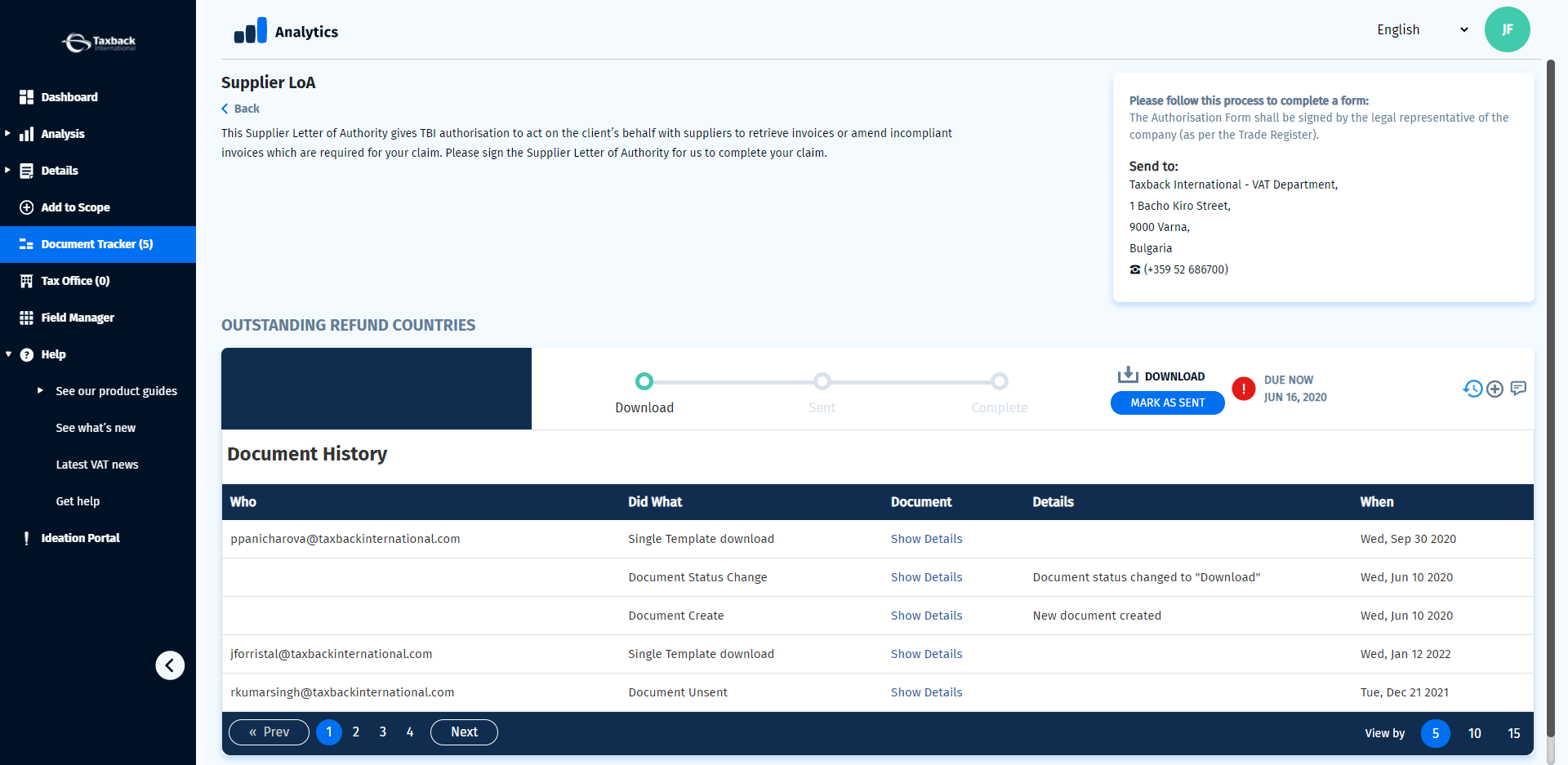

View the history of any actions attached to this document

Add comments and view comment history

Clicking on the Tracking icon enables one to attach the Courier Name, Tracking Number and any additional comments to the document

The history icon for each document will provide you with a detailed account of all actions or events relevant to that document.

At Taxback International we aim to maximise your reclaim and minimise risk with effortless solutions for VAT reclaim and compliance. Our Document Tracker is one such example of how we enable an effortless implementation for our customers. You can read more of the success stories from just a few of our thousands of happy clients around the globe by clicking here.